Pensions and Taxes Increase While Labor Unions go Unchallenged

In January 2015, the Manhattan Institute’s Steve Malanga, writing in the Wall Street Journal about public pension costs gulping down tax raises, quoted me saying that no matter what local politicians tell voters, when you see tax increases, think pensions.

To paraphrase Ronald Reagan: Here I go again!

Recent accounts indicated that the California Public Employees’ Retirement System (CalPERS) unfunded pension liabilities have increased because CalPERS investment revenue has dropped. Yesterday on this site, David Kersten cited the dramatic increase of CalPERS unfunded liabilities rising from $93 billion two years ago to $150 billion today.

More to the point, Sacramento Bee columnist Dan Walters wrote, “CalPERS has been demanding hundreds of millions of dollars in additional contributions from state and local governments – hitting cities particularly hard…”

Despite a 42% growth in California’s general fund budget compared to 2011, the state continues to propose new tax increases and extensions.

Despite a 42% growth in California’s general fund budget compared to 2011, the state continues to propose new tax increases and extensions.

With the obligation for more local taxes going to cover pension costs is it just a coincidence that so many tax increase measures are popping up on local ballots?

I don’t think so.

Sure, there will be specific reasons that local governments say they need more tax revenue. More for police or transportation or the homeless, they will say. The governments would have more revenue for those services if they did not have greater obligations for underfunded pensions.

It’s not like revenues have declined recently in government coffers. The state general fund budget is up 42% since Jerry Brown came into office in 2011. Local governments also are enjoying revenue increases, but the call for more taxes keep coming.

Take San Francisco, which could see 8 different tax increases on the November ballot. We just learned that property tax collections in the City by the Bay dramatically increased 9%. And, the city government still needs all that revenue from 8 new tax increases?

Money in government budgets is fungible to some extent. If you cover specific agency costs with a targeted tax increase, that frees up general fund money for other items, including pensions.

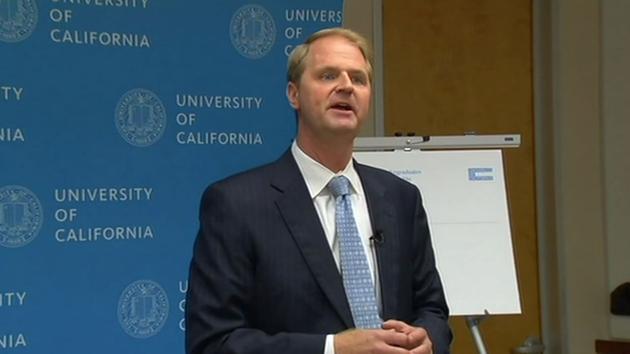

Nathan Brostrom, Chief Financial Officer for the University of California, told the Sacramento Bee that tuition hikes could be avoided if the state would assist in funding its retiree costs. He explained that the school believed it was not getting what was promised from the Prop. 30 tax hikes.

Nathan Brostrom, Chief Financial Officer for the University of California, told the Sacramento Bee that tuition hikes could be avoided if the state would assist in funding its retiree costs. He explained that the school believed it was not getting what was promised from the Prop. 30 tax hikes.

When the University of California declared a shortage of money a couple of years ago much angst surrounded the need to raise already high tuitions. What was the money needed for? As I wrote at the time, the UC’s chief financial officer told the Sacramento Bee that tuition hikes could be avoided if the state helped with retirement costs.

It wasn’t only the university system that saw money diverted for retirement costs. The aforementioned article by Steve Malanga in the Wall Street Journal was subtitled: Remember that ‘temporary’ tax hike for California schools? Most is now going to public worker retirements.

Ironic that the extension of those temporary taxes, Proposition 55, is on the ballot while the retirement system sputters—or is it?

As David Kersten pointed out in his column, “California Democratic politicians are too tied to their base which is the public employee unions, and are unable to make decisions that will benefit the state’s future and prevent financial catastrophe.”

That’s consistent with what I heard from one prominent Democrat who wondered with a state budget increase of more than a third over five years why so many state agencies say they don’t have enough money. The politician answered the question by saying it was because of pension and health care costs and that the majority Democrats would not take on the unions over that issue.

Too bad. That means it falls to the taxpayers. Either they pay up or reform the system on their own.

About the Author: Joel Fox is Editor of Fox & Hounds and President of the Small Business Action Committee. This article originally appeared in Fox & Hounds and appears here with permission.