On the chopping block: Gov. Brown joins the chorus of those predicting coming pension cuts

Sacramento

Lo and behold, it’s not just pension reformers and critics of the state’s massive pension funds who are worried about the sustainability of California’s pension systems. At a press conference announcing his proposed budget last week, Gov. Jerry Brown made some astounding comments. “When the next recession comes around,” he said, “the (next) governor will have the option of considering pension cutbacks for the first time in a long time.”

Brown not only believes that pensions can be cut. But he makes clear that pensions are likely to be cut. And he seems to be suggesting that they will need to be cut. “There is a lot more flexibility than is currently assumed by those who discuss the California Rule. At the next downturn when things look pretty dire, (pensions) will be on the chopping block,” Gov. Brown said, according to a Sacramento Bee report. Read that again. Pensions will be on the chopping block.

Brown is referring to a series of high-profile cases that are coming before the California Supreme Court later this year. The high court has agreed to review two of them (and is awaiting an appeals court ruling on a third one) relating to the “California Rule,” a series of court interpretations that bar state and local governments from ever reducing the pension payments to current employees even as they become unaffordable and threaten the health of the entire pension system.

In one case, a local union is challenging Brown’s 2013 pension-reform act, which capped certain benefits such as “airtime” – allowing employees to buy fictional years of service to inflate their permanent pension payments. The Brown administration is defending its signature pension-reform law in court. That’s not surprising. Even the California Public Employees’ Retirement System defends the savings that have resulted from that law. But the governor’s legal team has gone further by making arguments that could result in the paring back – or elimination – of that “rule.”

It will be interesting to see how CalPERS, the union-controlled pension fund that denies that people’s pensions face serious risk, will play that one. Whenever a pension reformer points out the tenuous financial condition of the pension funds, the current system’s defenders claim that critics want to deny public employees a decent pension. Or that they are exaggerating the extent of the problems. The pension funds are earning generous returns on their investment dollars – and there’s nothing to worry about, CalPERS notes.

Indeed, the CalPERS website features a “For the Record” section, in which the pension fund’s public-relations folks rebut particular criticisms. It’s enlightening mainly because of CalPERS’ apparent insistence that high rates of stock-market returns, which buoy the underfunded system, will continue without problem. In a November 21 rebuttal, CalPERS accuses critics – this one included – of “selectively min(ing) the facts so they can advance their anti-pension platforms.” Yet the governor knows the facts as well as anyone.

“CalPERS pays pensions for decades to come,” the agency insists. “Our Investment Office and actuaries must take into account carefully considered projections 10 years … and beyond. In fact, the new investment portfolios and asset allocation mix the CalPERS Board is considering, looks at returns over the next 60 years.” The implication is there won’t be any problem fulfilling pension promises well beyond most of our lifetimes.

But the idea that pensions might one-day soon be on the chopping block isn’t news for pension reformers. According to California Policy Center estimates, the state’s total unfunded state liabilities and debts, including pensions and retiree medical care, are $1.3 trillion if the pension funds used a realistic, risk-free rate of return for their estimates. California cities are likely to face their fifth fee increase from CalPERS in five years to pay for recent funding shortfalls. They continue to slash services to make up for these increasing costs.

CalPERS is only 68 percent funded. The California State Teachers’ Retirement System, the state’s other massive pension fund, is only 64 percent funded. That means they only have around two-thirds of the dollars needed to fulfill all their pension promises. CalPERS assumes a rate of return on its investments of 7 percent (down from 7.5 percent) but only assumes a 2 percent rate of return when agencies leave the CalPERS system. That’s the rate that CalPERS assumes when its own money is on the line and the fleeing agencies can’t rely on taxpayer backing. That should tell you something.

And the pension funds have dangerously low funding levels after the most recent year, where the funds have had fabulous returns. “Our investment portfolio has seen positive returns every year since 2010,” CalPERS boasts in that rebuttal column, titled, “Critics pick their facts but ignore the truth.”

Of course, CalPERS picks its years to measure investment returns – and ignores one of the biggest truths. The 1999 pension proposal, which became a law that increased pensions across the state, helped pave the current dire situation. Even great returns on investment can only go so far when the state gives 50-percent retroactive pension boosts to current employees.

It’s unfortunate that Jerry Brown hasn’t done more in his final two terms as governor to rein in the unsustainable pension benefits that he helped create in his first two terms. His early governorships greatly empowered the state’s public-employee unions, after all. His 2013 pension reform, while noteworthy, was modest and was designed mainly to reassure California taxpayers that he was serious about fiscal reform as he sought a large tax increase to fix a deficit problem.

Nevertheless, as the governor heads into the political sunset he recognizes that the current pension system is unsustainable without some significant changes in the law. He sounded just like a pension reformer at his press conference, but it will be interesting to see what CalPERS has to say about that. It’s not as if the fund can portray the governor as someone who selectively mines the facts to promote an anti-pension platform. He’s just telling it like it is.

Steven Greenhut is contributing editor for the California Policy Center. He is Western region director for the R Street Institute. Write to him at sgreenhut@rstreet.org.

As of a few days ago, high-wage earners have a new reason to leave California: their state income taxes are no longer deductible on their federal income tax returns.

Can California’s union-controlled state legislature adapt? Can they lower the top marginal tax rates to keep wealthy people from leaving California?

The short answer is, no, they cannot. They cannot conceive of the possibility that California’s current economic success is not because of their confiscatory policies, but in spite of them.

Earlier this year California’s union controlled legislature approved a gas tax increase that will increase state tax revenue by about $5.0 billion per year. Next in their sights is changing property taxes to a “split roll” system, whereby all commercial properties will no longer be protected from steep tax rate increases. Also under consideration is extending sales taxes to services, along with taxes on water, marijuana, and, who knows, maybe even robots.

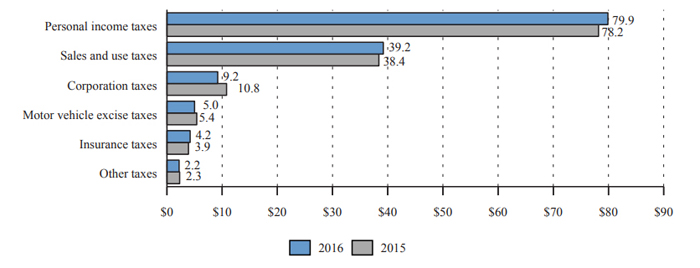

These new taxes have attracted a lot of attention, but in reality California’s state government derives most of its tax revenue, 58%, from personal income tax. In recent years personal income taxes have contributed as much as 65% of the California state government’s total tax revenue. California’s top marginal income tax rate of 13.3% is by far the highest in the U.S. Oregon has the 2nd highest rate, at a much lower 9.9%. The impact of this can be seen on the chart depicted below, which is taken from the State Controller’s most recent annual financial report for the fiscal year ended June 30, 2016. As can be seen, state income taxes accounted for 58% of all tax revenue in the most recent fiscal year for which we have data. Nothing else even came close.

California Tax Revenue By Source – 2015 and 2016

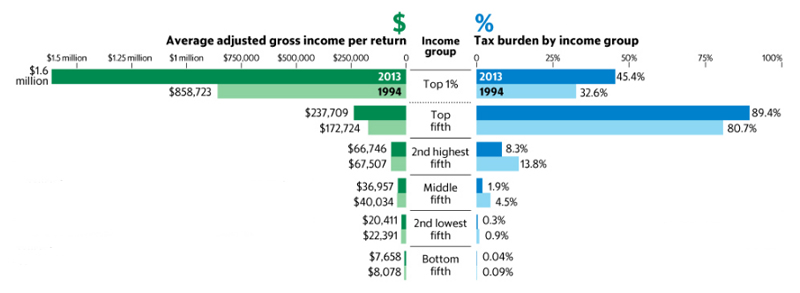

When around 60% (or more) of all state tax collections depend on how much money individual residents make each year, revenue can be volatile. A recent analysis by the Franchise Tax Board, as reported in the Sacramento Bee, showed that the top 1% of California taxpayers by income paid 45% of the total income taxes collected. This means that in the last fiscal year, the top 1% paid 26% of ALL taxes collected in the State of California. If you extend that comparison to the top fifth – those Californians who earned on average over $237K in 2013, it can be seen they paid nearly 90% of the total income taxes collected, or 51% of ALL taxes from all sources.

California Income Tax Burden by Income Group – 2013 vs 1994

When you have the top fifth of your wage earners paying more than half of ALL taxes collected in your state, you definitely don’t want those folks moving to other states. California has really great weather, but there are a lot of reasons to leave: An inhospitable business climate, a global economy with burgeoning new opportunities in many low tax regions, and an increasingly virtual work environment which means you don’t have to live within 50 miles of the California coast in order to attract venture capital or find business partners.

Just for the sake of argument, here are ways to cut expenses in the state budget, in order to keep California’s state government solvent without punishing the wealthy, or, worse, losing them to other states and nations.

HOW TO REDUCE THE CALIFORNIA STATE BUDGET BY $40+ BILLION

(1) Reduce Costs for Prisons – $2.0 billion or more: California now spends over $75,000 per year per prisoner, a cost that has doubled since 2005. In Alabama, it costs less than $15,000 per year per prisoner. If California contracted with the State of Alabama to have them house its 130,000 prisoners, that would save California taxpayers $7.8 billion per year. If doing business with Alabama is unpalatable, how about right across the border in Nevada? The State of Nevada spends under $18,000 per year to house their prisoners – sending California’s prisoners across the Sierras to Nevada could save taxpayers $7.4 billion. Obviously relocating California’s prisoners to other states is an extreme solution. But there are many other less extreme, bipartisan solutions to lower prison costs, including alternatives to incarceration.

(2) Cut Ratio of Administrators to Faculty in Public Universities – $2.0 billion or more: In 2000 California’s UC System employed around 4,000 administrators and 7,000 faculty. Only 15 years later, in 2015, the UC System employed 10,500 administrators and 9,000 faculty. Just assuming for a moment that the administrative overhead in the UC System wasn’t already bloated in 2000, the UC System could reduce their administrative headcount by over 5,000 administrators, and save at least $500 million per year. Do the same thing in California’s much larger Cal State and Community College systems, and you can probably achieve total savings of around $2.0 billion per year

(3) Outsource CalTrans Work and Eliminate Redundant Positions – $2.5 billion or more: CalTrans is set to consume $12.8 billion of the State 2017-18 budget. As recommended by State Senator John Moorlach after an audit of the agency, just eliminating 3,500 redundant positions would save $500 million. But competitive outsourcing of roadwork contracts could save much more. CalTrans only outsources 10% of its roadwork, whereas, for example, Arizona outsources 80% of their roadwork. It is common to take competitive bids from private contractors to do public road maintenance and upgrades – CalTrans is the exception. A very expensive exception.

(4) Fund all CalTrans Work With Proceeds from Bullet Train Financing – another $10 billion per year for ten years: Ok, this isn’t entirely fair. Bonds are deferred taxes. But just imagine if instead of paying for a train that will never make any meaningful contribution whatsoever to relieving the congestion on California’s roads and freeways, all that money was used to improve the roads? Redirecting Bullet Train funds – which are destined to total well in excess of $100 billion – into CalTrans projects would save taxpayers nearly 100% of CalTrans budget for a decade or more.

(5) Slash State Agency Headcount and Pay/Benefits by 20% – $6.5 billion: In 2015 the average pay and benefits for the 154,000 full time employees of state agencies was $116,887. Eliminating 20% of these jobs would save taxpayers $3.6 billion per year. Reducing pay and benefits for the 123,000 remaining state employees by 20% would save another $2.9 billion – their average pay package would “only” be $93,500 per year after this reduction. Is this feasible? Recent history proves that it is. In 2009, cash-strapped California state agencies implemented “Furlough Fridays,” which functionally achieved both objectives described here – there was a 20% reduction in work being performed, and state workers collected 20% less in pay. And guess what? The state government continued to function.

(6) Reform Pensions – $2.1 billion: When you talk about pensions, it is understating the problem to restrict the discussion to state agencies. Local cities, counties and school district pensions combine with state agencies to produce an unfunded liability that – depending on who you ask – ranges between $200 and $700 billion. Moreover, pension reform might be subsumed under the preceding Option #5. Nonetheless, here are the numbers for state agencies: Taxpayers contribute, on average, $21,900 towards each state workers pension, representing 26% of their pay. Just lowering that to a contributory 401K equivalent to 10% of pay would save at least $2.1 billion per year. In reality, because these pensions are so underfunded, getting control of pension benefits would actually save much more than this estimate.

(7) Face Reality and End the “Sanctuary State” – around $20 billion: According to the United Nations, there are now over 250 million displaced refugees in the world. Right behind them are another 1.2 billion individuals living in extreme poverty. America, with only $330 million residents, is not nearly capable of absorbing even a fraction of these multitudes, much less California with not quite 40 million residents. Yet California has thrown open the doors and foots the bill, betting that the tech boom and asset bubble will last forever. A study by the Federation for American Immigration Reform estimated the cost of undocumented immigrants to California taxpayers at over $25 billion per year – $14.4 billion for education, $4.0 billion for health care, $4.4 billion for justice and law enforcement, $0.8 billion for public assistance, and $1.6 billion for general government services. This scrupulously footnoted study, published in Sept. 2017, got virtually no coverage in the media. What did receive extensive media coverage was a study promoted by the Institute on Taxation and Economic Policy that estimated the total state and local taxes paid by California’s illegal immigrants to equal nearly $3.0 billion per year. Net cost and potential savings: $22 billion. At the least, California should stop being a magnet state for undocumented immigrants, and instead should help craft then adhere to a realistic national policy.

The most powerful special interest in California, government unions, wants nothing to change. They are hostile towards corporations and individual wealth. They have strong incentives to want inefficient, expensive prisons, universities, and infrastructure projects. They have strong incentives to expand all government services to accommodate destitute immigrants. Why? Because the more government workers are hired and the more taxpayers’ money is wasted, the more dues paying government union members they acquire.

Joining these government unions are California’s powerful Latino Legislative Caucus and their allies in the identity politics industry, who recognize a huge political opportunity by spewing separatist demagoguery, nurturing a bleak, tribal paranoia in the collective minds of recently arrived immigrants. Also joining these government unions are left-wing oligarchs and the monopolistic businesses they control, who see in an expanded government and a hostile business climate a chance to prosper through legislated scarcity and mandated product choices. And, of course, the asset bubbles produced by contrived shortages add precarious value to the pension funds and increase property taxes.

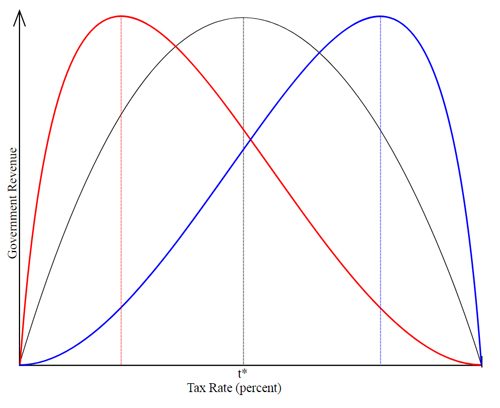

So these solutions, while eminently practical, may never see the light of day. But California’s voters should understand that around $40 billion could be cut from the state budget if California’s government was ran in the interests of the people, instead of in the interests of government unions and their elitist allies. If $40 billion were cut from California’s state budget, not only could the new gas tax be repealed, but the top marginal tax rate could be dropped to under 10%. And as any student of the Laffer Curve knows, that might actually keep California’s wealthy from leaving; it might even cause income tax revenue to go UP, as fewer high income individuals feel the need to shelter or defer their taxable earnings.

The Laffer Curve

Depending on where you are on the curve, lowering taxes can raise tax revenue.

* * *

Edward Ring is a contributing editor for the California Policy Center.