California’s largest school districts are underwater

California school districts are receiving $15.3 billion in federal aid to help students recover from the extended school closures, but the poor fiscal health of some school districts within the state may limit how well that money is spent.

At $122 billion, a recent analysis of the federal Elementary and Secondary School Emergency Relief Fund authorized this past March is unprecedented. This most recent aid package, which follows massive relief authorized by Congress earlier in the pandemic, is more than thirty times the size of the “Race To The Top Fund” created during Obama’s presidency. The amount coming just to California school districts is astounding. The Los Angeles Unified School District, for example, is receiving $4.7 billion in one-time relief.

With money like this, it’s no wonder the teachers unions, like the United Teachers Los Angeles (UTLA), are lobbying heavily for pay raises and increased staffing which will have substantial on-going and long-term costs for the district. And while districts can debate the best strategies to address the learning loss from the last year and a half and get students back up to grade level, they must also consider the impact of using one-time aid in creating recurring costs that LAUSD and other districts simply cannot afford once federal stimulus money dries up.

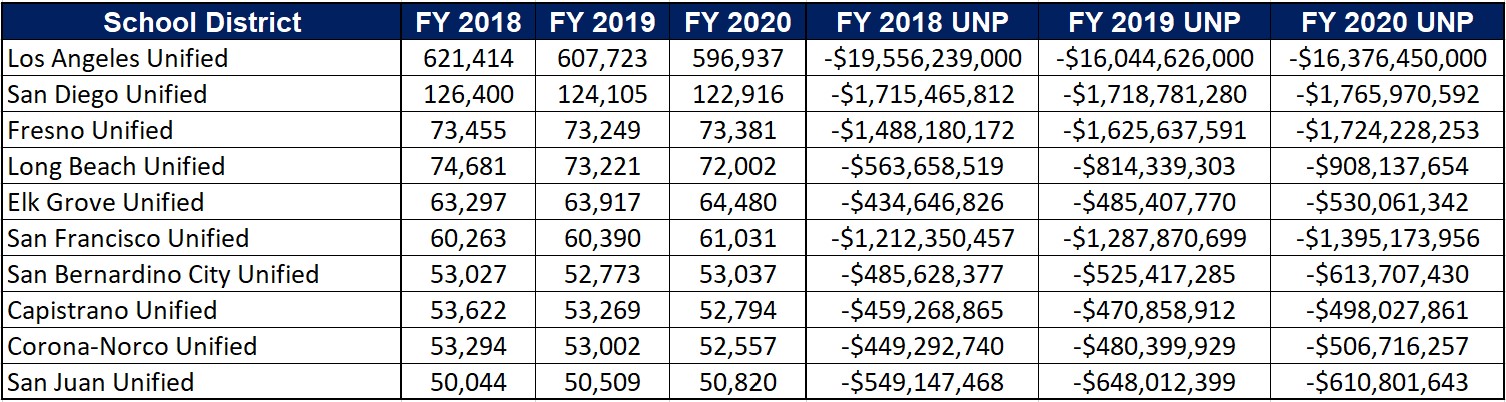

We decided to look at California’s ten largest school districts to examine their fiscal health, considering their three most recent, comprehensive annual financial reports and their unrestricted net positions. The unrestricted net position, explained by Truth in Accounting, is a “magic number” of sorts that shows whether a government agency – school districts in this case – has the assets needed to cover costs funded by future generations of taxpayers. Prudent school boards will have a positive number that functions as a proxy for their financial health.

As seen in the table below, not one of California’s largest school districts has the assets needed to pay future bills when they come due.

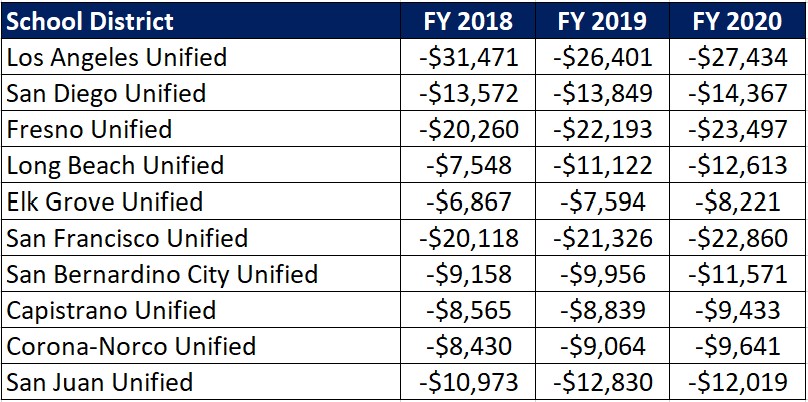

Breaking the number down to a per-pupil level demonstrates the gravity of the problem.

You can find the full spreadsheet with the sources HERE.

Looking at these tables, the debt of the top three has been consistent over the past three years. Los Angeles Unified, Fresno Unified, and San Francisco Unified have been in the hole for $20,000 or more per student for each of the last three fiscal years. While the unfunded liabilities of some of these districts have been gradually increasing over the past few years, some districts, especially Long Beach, are increasing those liabilities at an alarming rate.

Looking back at the federal relief money these school districts will be receiving, there are numerous ways districts can spend this one-time aid that will help students without driving districts deeper into debt. Before districts consider burdening taxpayers with more ongoing, recurring costs, they should take a close look at their financials. After all, it’s today’s students who will foot the bill for today’s spending.