A different kind of pandemic is stalking California’s cities

Image: San Gabriel (Creative Commons)

If you’re looking for dark entertainment, you could do worse than the reality show unfolding throughout California. First, state and local officials supported the nearly total shutdown of the state’s economy as a necessary response to Covid-19. That killed the sales and other tax revenues that are the life’s blood of local government operations.

A new report from California Policy Center reveals that some California cities entered the pandemic unprepared to manage the financial implications of any recession, never mind the current near-total shutdown.

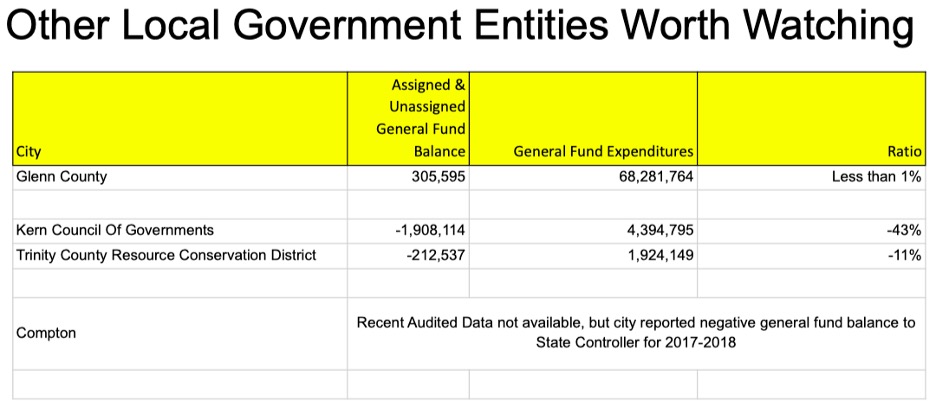

The crisis won’t end when the state reopens. Many local governments will be forced to cut services; in most of those, public officials will also propose a disastrous regime of business-stifling taxes and debt. The new California Policy Center survey of some 300 California communities reveals that some cities, counties and other agencies are in such dire shape that their best option may be federal bankruptcy.

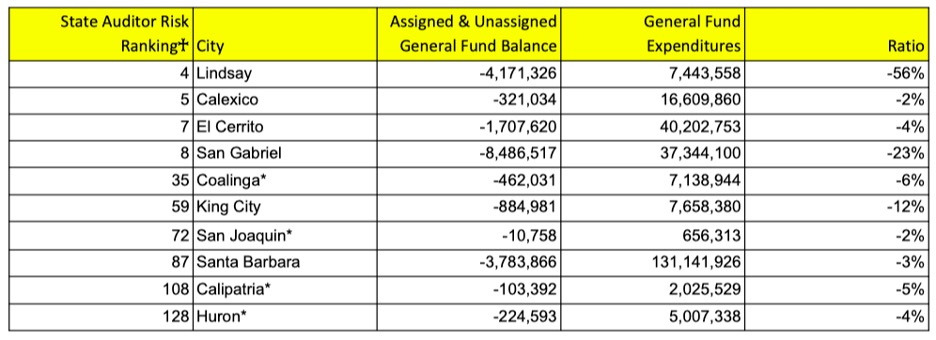

Here are California’s 10 worst cities:

NOTES:

♰ – State Auditor published a ranking of 471 cities by degree of financial risk, with 1 being riskiest.

* – Data from 2018 financial statement, because 2019 statement was unavailable as of late April.

California Policy Center analysts began with the state auditor’s comprehensive 2017 review and ranking of local government finances. With this report as their starting point, CPC examined more recent Comprehensive Annual Financial Reports to determine how much cash each government entity has on hand – cash these governments will need to survive the sales-tax crash.

How much cash is necessary? The Government Finance Officers Association recommends that local governments maintain reserves equal to two months of annual expenditures. This suggests that the ratio of Assigned and Unassigned General Fund Balances to Annual General Fund Expenditures should be at least 2/12 (that is, two months out of 12 months) or 16.67 percent of total annual spending.

Our analysis found that many California cities have general fund balance ratios well below this recommended level; some entered the crisis with negative general fund balance ratios – meaning that their cupboards were bare before the current pandemic.

Local government watchdogs – reporters, activists, taxpayers and others – will want to watch for red flags. The most likely reaction among officials in troubled communities will be to raise taxes and issue new bonds. This of course will undermine economic recovery and prolong the financial crisis.

If they are truly concerned about the root causes of their financial trouble, these officials have a legitimate alternative solution: Chapter 9 bankruptcy. Unlike California state judges, federal bankruptcy judges have shown a remarkable willingness to unwind the disastrous pensions that constitute the biggest problem in municipal finances.

That, of course, would require our political leaders to turn on the union leaders who financed their political campaigns in the expectation of a payback. Doing that will require courage.