A Pension Recommendation for the California Teachers Association

This week a fascinating article on the website of the Education Intelligence Agency revealed that the California Teachers Association, one of the most powerful labor unions in the world, is itself having labor problems. Moreover, the labor problems they’re encountering are because they’re trying to be fiscally responsible.

Setting aside for a moment all the grievances that education reformers and concerned parents may have towards the CTA, what they are experiencing right now is an opportunity for a broader consensus to form on one specific and very big issue; pension reform.

It shouldn’t be necessary to explain that California’s public employee pension systems are in trouble. Back in 2019, despite still being in a bull market lasting over a decade, most of California’s public employee pensions systems were already challenged; CalPERS reported their system to be 71 percent funded as of 6/30/2019, and CalSTRS reported an even more dismal 66 percent funding.

And then came COVID. Despite the COVID shutdown affecting at most half their fiscal year, CalPERS reported earnings for the twelve months ended 6/30/2020 of only 4.7 percent, and for the same period CalSTRS reported earnings of only 3.9 percent. To say the bull market is over is inadequate. We are at the end of an era.

The CTA can lower their pension formulas to CalSTRS levels

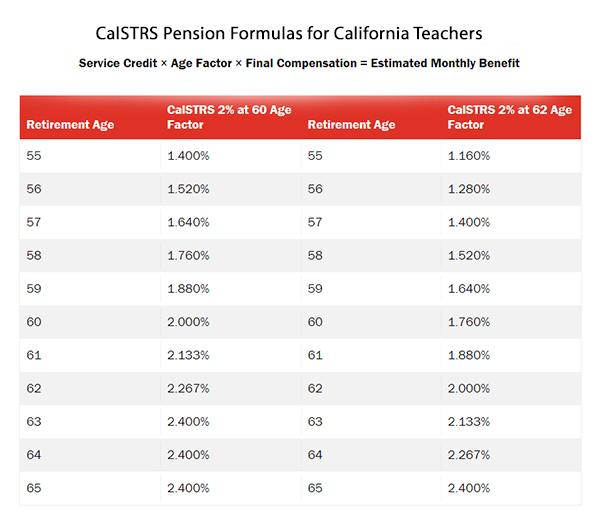

Someone unfamiliar with the CTA’s employees might assume that these union professionals representing teachers receive the same pension benefits as the teachers they represent. Not so. The following chart shows the pension benefit plans for teachers who are part of the CalSTRS system.

The above chart, taken from the CalSTRS website, offers a fairly typical snapshot of how defined benefit pensions work. As noted in the overhead caption, “service credit” refers to the number of years an employee worked. The “age factor” or multiplier, is used to calculate the pension. The chart shows two cases, columns 1-2 for employees hired before 2013, columns 3-4 for employees hired during 2013 or afterwards.

As can be seen, the baseline retirement age for pre-2013 CalSTRS participants is 60, and for post-2013 participants it is 62. In both cases, if they retire in their baseline year, their pension is their final pension-eligible salary times the number of years they worked, times 2.0 percent. If they retire earlier, that 2.0 percent multiplier is lowered, and if they defer retirement, the multiplier is raised. This is done in an attempt to equalize the overall value of a retirement. If you retire early, you collect less money per month for a longer period of time. If you retire late, you collect more money for a shorter period of time.

The CTA’s Own Union Employees Have a Better Pension Formula than CalSTRS

The CTA may be a labor union, but the professionals who work for the CTA are themselves represented by a union, the “California Staff Organization” (CSO). As videos on their website attest, the members are upset at changes the CTA is proposing to its pension plan.

The pension system for CTA employees is the “California Teachers Association Employees’ Retirement Benefits Trust.” As disclosed to participants in 2019, this pension system is entering a “critical” status which under federal law means it will have to adopt a “rehabilitation plan” to restore the plan to good financial health.

As a digression, the CTA’s pension system, unlike CalSTRS and CalPERS, is subject to federal oversight under the Employee Retirement Income Security Act of 1974 (ERISA). Why public employee pension plans are exempt from ERISA is indefensible, but that is a discussion for another day. Under ERISA, the CTA’s plan is considered in critical condition even though it is 75 percent funded, better than CalPERS or CalSTRS. Let that sink in.

To financially rehabilitate their pension system, the CTA is proposing an assortment of revisions to the benefit formulas, presumably in search of a combination of changes that will be accepted by their employee union and also pass review by federal regulators. But what are the benefits today?

To answer this, a good source are the FAQs released by the CTA to describe the proposed changes to their members. According to this document, question 12 describes the current plan. It offers a 3.0 percent multiplier at age 65, which is better than what CalSTRS teachers get – referring to the above chart, the CalSTRS multiplier at age 65 in only 2.4 percent. But that’s not the whole story.

CTA employees also get what is called an “early retirement subsidy,” which in effect means the 3.0 percent multiplier is used at any point after age 50. This is an incredibly generous value. Eliminating it retroactively would indeed have a dramatic impact on the expectations of CTA employees nearing retirement. Eliminating the subsidy just for future work would still be a significant change, one that would certainly be easier to defend as equitable.

But why, thanks to the “early retirement subsidy,” are CTA employees getting a 3 percent at 50 retirement package, when the teachers they represent were getting a 2 percent at 60, and only 1.4 percent at 55? Why are CTA employees earning a pension benefit literally twice as valuable as the teachers they fight for?

There’s obviously a lot more to this story. Maybe taking into account other factors, such as the level of employee contributions to their pensions via payroll withholding, the CTA pension benefit isn’t twice as valuable as the CalSTRS benefit for teachers. That’s fine. Taking everything into account, it’s still a lot better.

Not all advocates for pension reform call for elimination of the defined benefit plan in favor of a defined contribution plan. A defined contribution plan offers no guarantees to retirees, because only the employer’s contribution is fixed and guaranteed. If a person happens to retire during an extended period of market losses, or happens to live a longer than average life, they’re screwed with a defined contribution plan. This is why a defined benefit retirement plan, properly managed, is worth fighting for.

ERISA is a valuable tool to ensure defined benefit pensions stay within reasonable financial bounds. When the CTA’s pension plan strayed into financially unsustainable waters, ERISA came calling. Now the CTA management and workforce can use this opportunity to ask themselves: why on earth did we think we were entitled to a defined benefit retirement plan so much better than the teachers we represent?

The good news for CTA: If they lower their retirement benefit formulas to conform exactly to what CalSTRS offers, their funded status will likely crawl out of critical condition. And if they had a financially healthy retirement plan that was identical in structure to the CalSTRS plan, they would acquire at least some moral credibility when advocating to preserve CalSTRS benefits.