California Has Largest Unrestricted Net Deficit in US

Looking at the document, we are immediately informed on the first page of the Report Overview that the State Auditor has issued a modified opinion, consisting of a qualified opinion, for the balance sheet. This is a warning sign, or yellow light, for the reader to be aware that there is something that should be taken into consideration.

Why? It is a “result of the State’s inability to provide the California State Auditor with sufficient appropriate audit evidence to conclude that the aforementioned financial statements taken as a whole are free from material misstatement.” And this is due to the “ongoing financial accounting and reporting challenges experienced by one state department in administering California’s unemployment insurance program.”

That does not give the reader much comfort, and we’re just on the first page. This sad accounting malfeasance resulted in a significant restatement of the state’s liabilities. And generated an increase in the unrestricted net deficit of $47.4 billion. The increase in other current liabilities of $46.2 billion is the simple answer.

The state enjoyed $18.8 billion in revenues in excess of expenditures. But nearly a $40 billion increase in liabilities, for funds due to other governments and tax overpayments, more than ate it up.

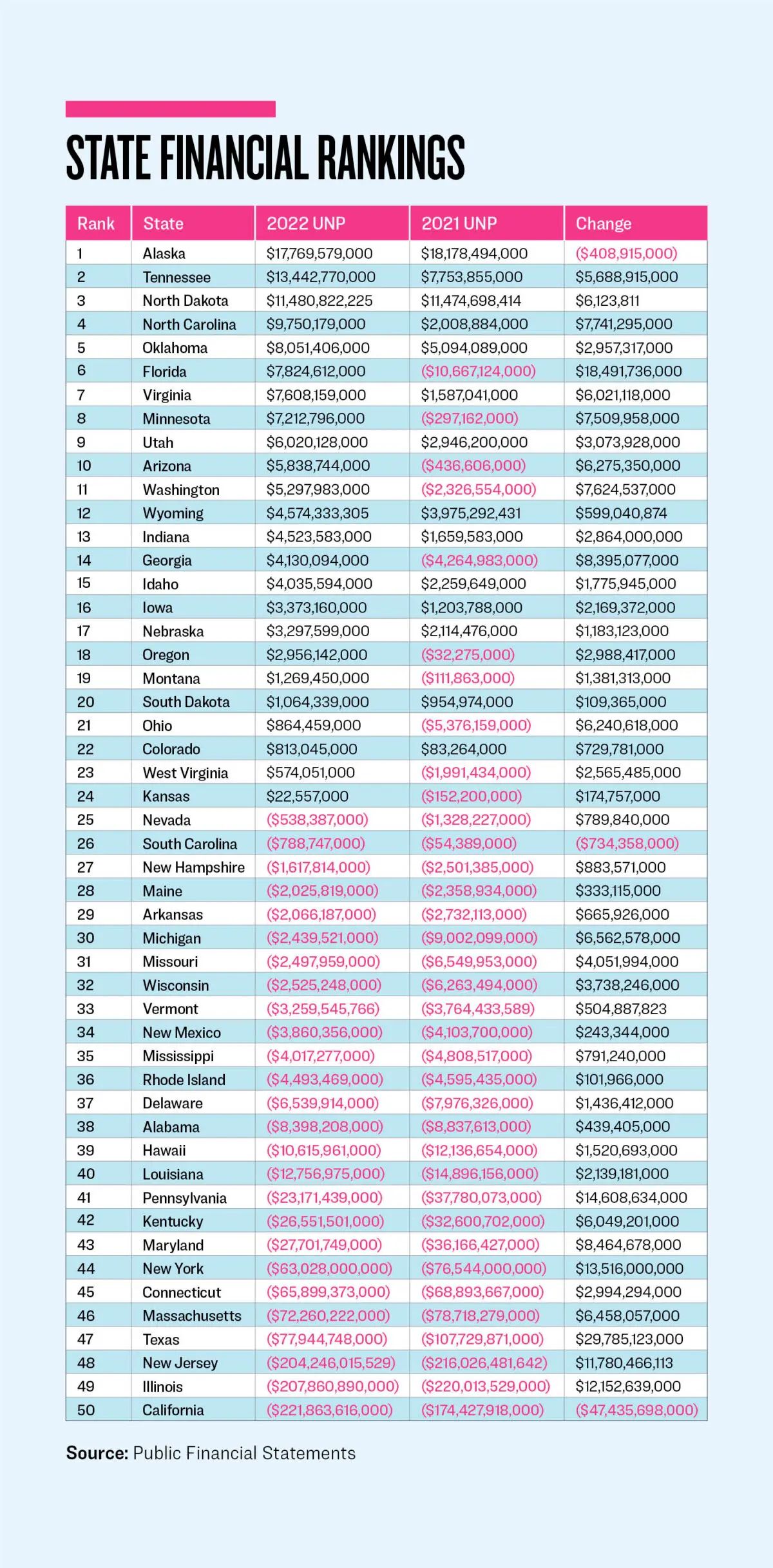

With a $222 billion hole, California now has the largest unrestricted net deficit in the nation. Of the 50 states, only three states saw their balance sheets worsen: Alaska, South Carolina, and California. The graph below shows the 47 states that improved their balance sheets, with significant help from the CARES Act (Coronavirus Aid, Relief, and Economic Act) and the American Rescue Plan Act of 2021.

The $47 billion occurred from a restatement at the beginning of the fiscal year, which means that the audited financial statements for the year ending June 30, 2021, were reflecting a better position than it should have presented. That means that the fiscal status of the unrestricted net deficit for the Golden State was understated for about two years from the Legislature and the public.

And the completion of the 2022 audit and its release to the public occurred more than a week after the March Primary, where it would have been helpful to California’s voters to know that it would be unwise to incur another $6 billion in debt that will occur due to the implementation of Proposition 1.

There may be some good news. In December, the U.S. Department of Labor released an Unemployment Insurance Program Letter that raises the possibility for states to apply their finality laws to CARES Unemployment Compensation claims. Last month, the Employment Development Department requested that three groups of CARES Act claims be considered and resolved. Consequently, approximately $29 billion of potential federal liabilities will be removed from future financial statements.

This would be an amazing gift for California, at the expense of the other 49 states that will see federal income tax revenues paying for California’s self-inflicted unemployment mismanagement. As if forgiving student loans was not enough, the federal deficit under Mr. Newsom and President Joe Biden is growing at a massive rate. No wonder Mr. Newsom is always bragging about Mr. Biden, he’s sucking up to benefit from the President’s unprecedented generosity.

Now we will probably wait another year for the State Auditor to complete California’s June 30, 2023, annual comprehensive financial report, which should have been finished three months ago, to see if the Golden State has let Illinois and New Jersey return to the bottom of the list again.

This article originally appeared in The Epoch Times