California’s State and Local Liabilities Total $1.5 Trillion

For Immediate Release

January 7, 2019

Contact

Dawn Collier

dawn@calpolicycenter.org

916-718-8572

California Policy Center

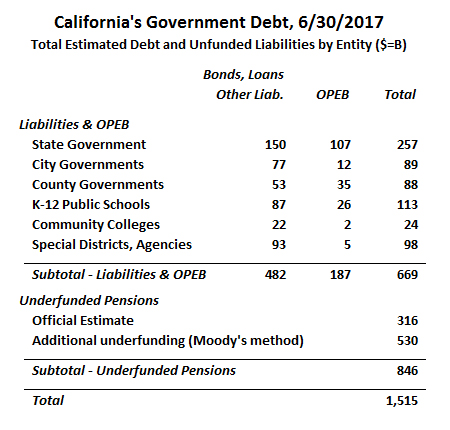

California’s total state and local government liabilities as of June 30, 2017, the most recent year for which a complete set of financial and actuarial reports are available, totaled just over $1.5 trillion. Over two-thirds of that total consists of unfunded liabilities for pensions and retiree health insurance for California’s state and local public employees.

That’s the finding of an in-depth analysis released this week by the California Policy Center.

“This year, California may have a state budget surplus of a few billion,” said California Policy Center president Will Swaim, “But California’s state and local governments are now carrying debt that amounts to literally hundreds of times more than this surplus.”

The new study found that bonds, loans, and other liabilities owed by California’s state and local governments amounted to $482 billion. “OPEB,” or Other Post Employment Benefits – primarily retirement health insurance benefits – totaled $187 billion. But the biggest component of state and local debt was pensions.

Study authors Marc Joffe and Edward Ring analyzed hundreds of financial statements from cities, counties, special districts, state agencies, and public sector pension funds. They contend that the officially recognized total unfunded pension liability, $316 billion, is understated by just over a half-trillion dollars.

“When we recalculated the unfunded pension liability using the Citigroup Pension Liability Index discount rate (3.87 percent in June 2017), which is recommended by Moody’s, we estimated that the real unfunded actuarial accrued liability (UAAL) for California’s state and local employee pension systems is $846 billion, which is $530 billion more than the officially reported total,” said co-author Edward Ring.

Even using the officially reported numbers for California’s state and local governments’ total unfunded pension liability, that, plus all other liabilities, totals $985 billion. Given the recent uncertainty in the stock market, and concerns about other investment assets such as bonds and real estate also being in bubble territory, that $985 billion is very likely a best-case amount.

As a matter of fact, using the methodology of the prestigious Stanford Institute for Economic Policy (which contends the “risk free” discount rate should be only 3.0 percent), we calculated the total unfunded pension liability at $1.26 trillion – $944 billion more than the officially reported total for pensions. That would put total state and local government liabilities in California at a whopping $1.9 trillion.

Read the full study here: California’s State and Local Liabilities Total $1.5 Trillion. The specific categories of debt tabulated in the study are shown on the following table:

“California’s state and local governments face serious financial challenges. Not only do they carry $1.5 trillion in debt and underfunded pensions. They also face billions in deferred costs to maintain and upgrade neglected public infrastructure,” said co-author Marc Joffe. “And state revenues are dangerously dependent on income tax revenue from high income earners – revenue that will largely evaporate in the next economic downturn.”