Local Voters Uphold Utility Tax in Sierra Madre

Voters in tiny, affluent Sierra Madre, three square miles of leafy neighborhoods nestled at the foot of the majestic San Gabriel mountains, had an opportunity earlier this week to repeal their utility tax. As reported in the San Gabriel Valley Tribune, by a margin of more than four-to-one, they decided to keep their tax.

Opponents of the utility tax repeal pointed out that Sierra Madre has very low per capita sales tax revenue (claiming 460th out of 481 California cities), and therefore depends on their utility tax. And in any case, the numbers are vanishingly small. Had Sierra Madre’s citizens voted to repeal their utility tax, it would have eliminated $2.6 million, or 24%, from the city’s annual revenue.

The real question facing Sierra Madre, and all of California’s cities, isn’t whether or not to repeal various local taxes, but how many new taxes to approve in the next few years. As documented by CalTax, every election cycle, hundreds of new local taxes are proposed, and they usually pass. For example, in November 2016, 224 new local tax increases were proposed, and 71% of them were approved by voters.

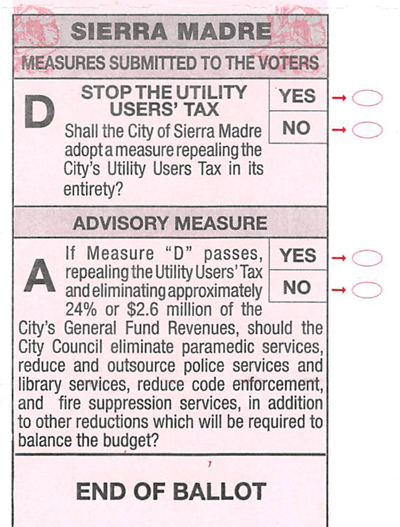

How these measures get approved by voters is nicely exemplified by the Sierra Madre ballot. Measure D, at the top of the ballot, presented the question to voters: “Shall the City of Sierra Madre adopt a measure repealing the City’s Utility Users Tax in its entirety?”

But below Measure D on this ballot was Advisory Measure A, which read “If Measure “D” passes, repealing the Utility Users’ Tax and eliminating approximately 24% or $2.6 million of the City’s General Fund Revenues, should the City Council eliminate paramedic services, reduce and outsource police services and library services, reduce code enforcement, and fire suppression services, in addition to other reductions which will be required to balance the budget?”

SIERRA MADRE SPECIAL ELECTION BALLOT – 4/10/2018

If that isn’t an anti Measure D campaign message masquerading as an “advisory measure,” then there’s a bridge for sale in San Francisco, and the moon is made of green cheese.

It’s worth wondering why the pro-repeal campaign didn’t just try to reverse Sierra Madre’s recent utility tax increase, instead of calling for its total repeal. After all, that tax has been in place since 1993. But in 2016, Sierra Madre’s voters approved an increase in the utility tax rate from 8% to 10%. Rolling back that increase, which equates to about a half-million per year in additional tax collections, would not have broken the city’s finances. It could have been marketed for what it would have been – a way to pressure Sierra Madre’s elected officials to finally confront their escalating pension payments.

ALL NEW TAXES ARE TO PAY MORE FOR GOVERNMENT PENSIONS

Beyond any serious debate by now is the fact that payments to CalPERS by California’s cities are set to nearly double in the next six years, from a projected total of $3.1 billion in 2017-18 to over $5.8 billion in 2024-25. This is based on recent “Public Agency Actuarial Valuation Reports” issued by CalPERS actuaries for each of their participating agencies, summarized here by the California Policy Center.

In the case of Sierra Madre, this year they will pay $1.5 million to CalPERS, which is 13.8% of their total general fund revenues. By 2024, they will be paying CalPERS $2.2 million, or over 20% of their total general fund revenues.

One in five dollars of Sierra Madre’s tax revenue will be paying for pensions. And that does NOT include (1) any payments for other post-employment benefits, (2) any increases to those payments based on investments deciding not to perform as well in the next ten years as they have in the past ten years (imagine that), or (3) any additional payments if Sierra Madre happens to have issued “pension obligation bonds” in prior years. We didn’t look into this, but plenty of cities have succumbed to the temptation to borrow money to make their pension payments.

One possible source of relief for this comes in the form of the CalFire vs CalPERS case that is working its way through the California Supreme Court. There is a possibility that a ruling could undermine the “California Rule,” which to-date has been aggressively – and successfully – interpreted by government union attorneys to mean that pension benefits cannot be diminished, even for work not yet performed.

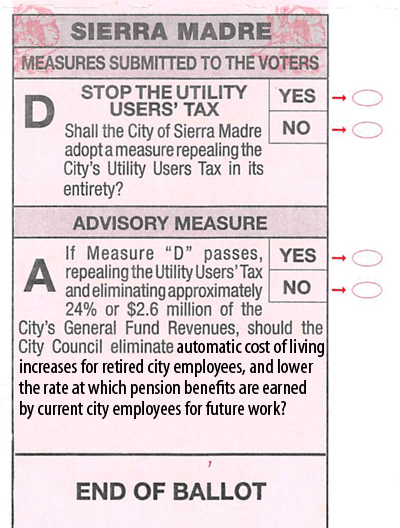

If the outcome of that case tilts in favor of reform, you might see this “advisory measure” on a local ballot, right beneath the next proposed tax increase.

HYPOTHETICAL SIERRA MADRE SPECIAL ELECTION BALLOT

(including “advisory measure” that proposes reducing pension benefits)

That would be the day. When immediately below a proposed tax increase, an “advisory measure” proposes to reduce pension benefits if the tax increase does not pass.

And that certainly would not be an anti-tax campaign message, would it?

* * *