Orange County’s School Districts Improve Fiscally Overall

Waiting for Orange County’s 28 school districts to post their annual audited financial statements for the year ending June 30, 2024, was an exercise in patience. All but one completed their audits before Dec. 31, which is extremely commendable. But five districts didn’t post their accountability requirements until mid-year 2025. Two were as late as June 3.

The laggard for this year and last was Magnolia Elementary, which completed its audit on April 17, 2025, and we’ll discuss why in the conclusion. But it was five months ahead of last year. And it still does not have its financial statements posted on its website.

Meanwhile, if you want the financial statements for Anaheim Elementary, you are told “Access denied,” and have to submit a request. This is unique for California’s 944 school districts. So much for transparency.

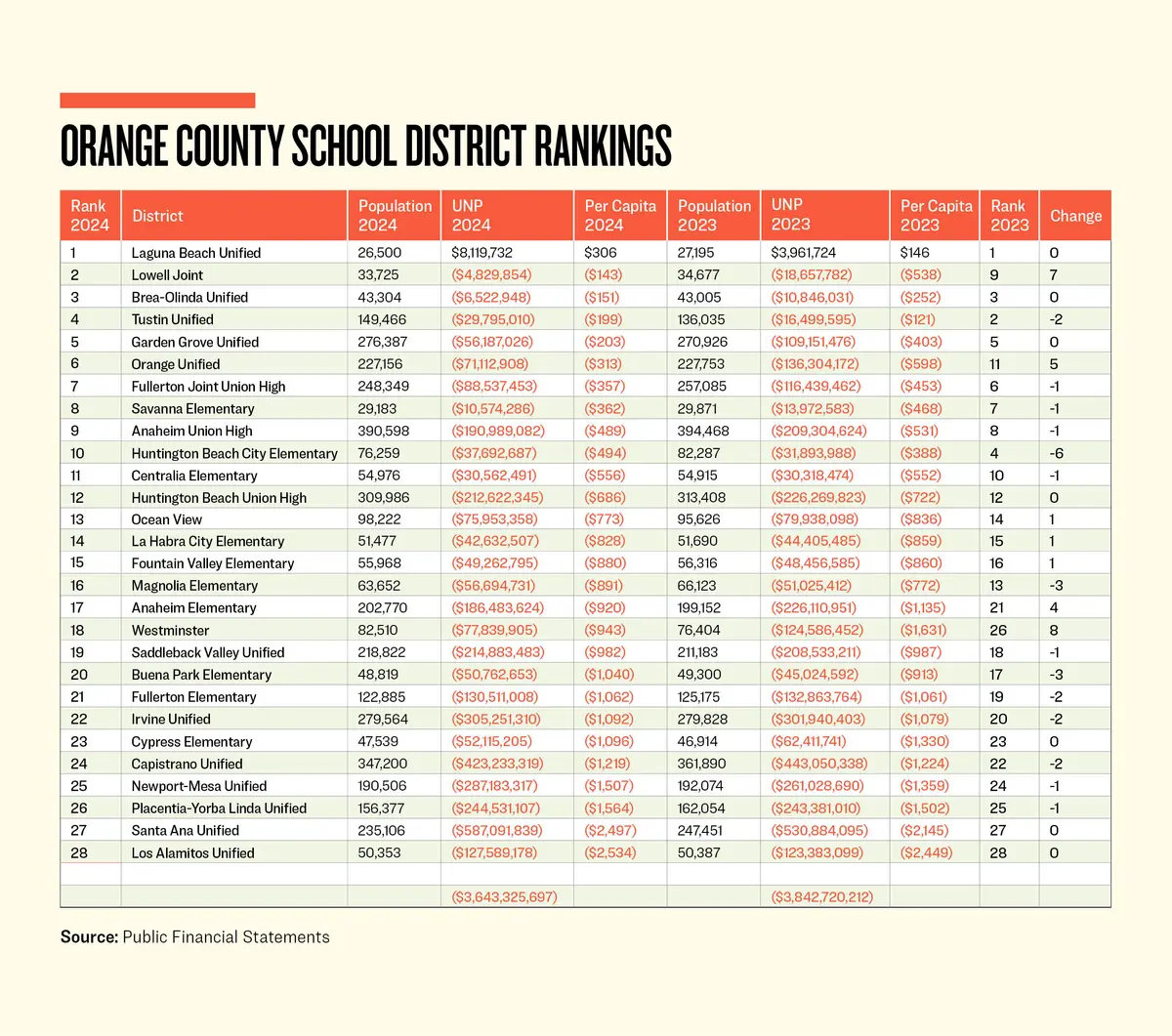

Fortunately, we have the audits now and there is plenty to discuss. Overall, Orange County’s school districts reduced their cumulative unrestricted net deficit by nearly $200 million. The leader of the pack, Laguna Beach Unified, the only district with a positive unrestricted net position, improved by 105 percent. Second place Lowell Joint reduced its unrestricted net deficit by 74 percent. But going in reverse was Tustin Unified, which increased its unrestricted net deficit by 81 percent.

The big positive movers were Anaheim Elementary ($39.6 million), Fullerton Joint Union High ($27.9 million), Garden Grove Unified ($53 million), Orange Unified ($65.2 million), and Westminster ($46.7 million).

Santa Ana Unified increased its massive unrestricted net deficit by 11 percent—we’re talking by $56.2 million! This was the biggest dollar increase in the wrong direction of all the districts. And their teacher’s union recently demanded raises and got them. Oops. No wonder they are facing layoffs of around 300 personnel.

If you are a young parent and concerned about raising your children in a school district that is not financially stressed, then consider purchasing a home within the districts closer to the top of the list.

Let’s take a closer look at the four districts that moved up and the four that moved down the rankings during the year.

Lowell Joint, one of the premier districts that recently moved under the authority of the Orange County Department of Education, from the Los Angeles Department of Education, moved up seven places. It restored the seven-place drop from last year. It did the opposite of what it did last year, moving $12.4 million out of restricted assets, explaining the bulk of the $13.7 million reduction of its unrestricted net deficit.

Orange Unified had revenues in excess of expenditures of $91 million, with a net investment in capital assets of $25.8 million explaining its improvement of $65.2 million. So, its newly constituted board of trustees, as the result of a successful recall by the teacher’s union, also gave out raises.

Three months after the close of the year, the district’s chief business officer informed the superintendent in a memo that “it appears that the adopted budget in June did not fully account for the ongoing costs of the raises” which will “require that some of the reserves will need to be used to meet our obligations … we are deficit spending.”

Anaheim Elementary moved up four places. It had revenues in excess of expenditures of $13.7 million and was able to put $9.8 million of it in restricted assets. But because it increased its general obligation bond debt by $81.3 million and only spent $19.8 million on capital assets, it reduced its net investment in capital assets by $35.7 million. The net of these activities improved the unrestricted net deficit by $39.6 million. Unfortunately, its net pension liability rose by $23.9 million and its unfunded liability for other post-employment benefits rose by $4.2 million.

The biggest upward mover was Westminster at eight places. It had revenues in excess of expenditures of $15 million and reduced its restricted assets by $20.7 million. It also increased its general obligation bond debt by $35.7 million but only spent $17.7 million on capital improvements. It would then reduce its net investment in capital assets by $11 million, for a $46.7 million decrease in its unrestricted net deficit. It also saw its net pension liability increase, by $12.6 million, as well as its unfunded liability for other post-employment benefits, by $4.2 million.

Tustin Unified only dropped two positions, but it is worth discussing. It only really dropped one position, as Lowell Joint jumped back up seven places. Tustin Unified had revenues in excess of expenditures of $81.9 million and moved $72.7 million into restricted assets. It increased its net investment in capital assets by $22.5 million, by spending on construction in progress and reducing its general obligation bond debt, resulting in a $13.3 million increase to the unrestricted net deficit. Its net pension liability also rose by $30.3 million. Why I keep bringing this up is because it will put a strain on the district’s budget and cash flow in future years by paying the increased annual required contributions.

Huntington Beach City Elementary saw its expenditures exceed revenues by $6 million, explaining the increase in its unrestricted net deficit by $5.8 million. With other districts reducing their unrestricted net deficits, it dropped six places.

Buena Park had adjusted revenues in excess of expenditures of $9.7 million. The adjustment also improved the prior year’s unrestricted net deficit by $13.3 million. It incurred additional debt for acquiring fixed assets, exceeding the book basis of its capital assets, and reducing the net investment in capital assets by $11 million. This also reduced this account to a negative balance of $2.2 million, a very rare oddity. The district restricted $45.6 million (taking it out of unrestricted territory). This explains the bulk of the $19 million increase in its unrestricted net deficit. As if there were not enough moving parts, its unfunded pension liability increased by $6.3 million. All to say how important it is to monitor what your school district board members are doing with your property tax dollars.

Let’s conclude with Magnolia Elementary, which dropped three places. It had revenues in excess of expenditures of $17.2 million and put $4.5 million into restricted status. It also increased its net investment in capital assets by $18.4 million. This explains the increase of $5.7 million in its unrestricted net deficit.

The outside independent certified public accounting firm that performed the audit provided a thorough discussion on attempts to discover fraud and errors by reviewing internal controls. The firm included a management letter within the financial statement report detailing concerns about the district’s internal controls and processes and observed the following:

“The District does not have procedures in place to ensure bank reconciliations are prepared in a timely manner and reviewed by an individual independent of the reconciliation process, which created the opportunity for an employee to perpetrate fraud.”

This helps to explain two things. The first is the lateness of the release of the audit report. The second is the skittishness it will cause for an auditor when someone perpetrates fraud. This occurred with the district when the former financial director, Jorge Armando Contreras, 53, pled guilty to an embezzlement scheme. Contreras absconded with $15.9 million over several years.

The main point here is that transparency is critical. When someone steals from or misspends funds of a school district, there are victims. They’re called students. And that’s why voters must be diligent and elect competent and financially literate school board trustees who will then hire skilled professionals to properly manage the finances and educational programs of your public school systems. Let’s hope Magnolia Elementary joins the other 27 districts in Orange County to have its June 30, 2025, annual audit concluded and posted before Dec. 31, 2025.

John Moorlach is the director of the CPC’s Center for Public Accountability. He has served as a California State Senator and Orange County Supervisor and Treasurer-Tax Collector.

This article originally appeared in The Epoch Times.