Pension Costs Are Still Eating Government Budgets

About 20 years ago, I read an ad in a local Sacramento newspaper that said “Get a government job and become an instant millionaire.” The ad went on to describe how public bureaucrats in California enjoyed benefits private sector employees can only dream of, including a guaranteed retirement pension worth the equivalent of millions of dollars in a private 401K plan. I’d had no idea. Most people still don’t.

Pension finance, and how pension obligations affect government budgets, remains one of the most consequential elements of public policy that nobody has ever heard of. Until someone is elected to a city council, or a county board of supervisors, and sees first-hand how pension payments crowd out other budget items, the typical response to pension policy debates is one of befuddlement or indifference.

But as they say, even if you are indifferent to pensions, pensions are not indifferent to you. Also about 20 years ago, a series of pension benefit enhancements enacted by gullible elected officials, egged on by aggressive pension system managers and public employee unions, led to pension payments moving from a negligible portion of civic budgets to ravenous monsters that threatened to drive into insolvency every government agency in the state. The result has been higher taxes and fewer services, and everyone feels that.

To begin to cope with out of control pension costs, in 2013 the California State Legislature enacted PEPRA, the Public Employee Pension Reform Act, which reduced the pension benefit formulas for new government hires, and phased in a cost sharing whereby all active employees would contribute more to their pension systems via payroll withholding.

The PEPRA reform, while incremental, has helped to financially stabilize California’s public sector pension systems. But because the PEPRA reforms were primarily restricted to new hires, the savings generates will happen slowly and will take decades to be fully realized. Meanwhile, the cost to California’s cities and counties to pay their pensions has reached record highs.

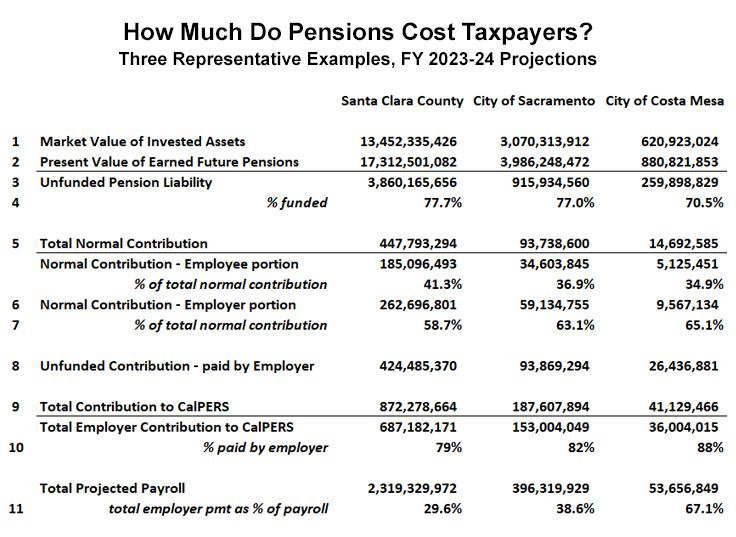

To more thoroughly illustrate what California’s government agencies are up against, the following chart depicts the financial status of three representative entities, each of them a rough order of magnitude apart in size. All three are clients of CalPERS, the largest of California’s state and local pension systems, with nearly 1,700 active clients and assets that have exceeded $500 billion.

The statistics depicted below, although mind numbingly opaque to the uninitiated, nonetheless distill the financial obligation represented by pensions to a few key variables. With the exception of “Total Civic Budget” the context providing denominator offered in the final block of numbers on the chart, all of these figures come directly from CalPERS itself. For each of their clients, CalPERS provides a “Public Agency Actuarial Valuation Report.” They are highly reliable since they disclose exactly how much CalPERS intends to charge each of its clients. The data shown on the chart pertains to the 2023-2024 fiscal year, which begins in July 2023.

The first three rows of data on the above chart report (1) how much CalPERS has invested on behalf of each client, (2) the present value of how much CalPERS expects at this point in time to eventually pay out in pensions to each client’s retirees, and (3) the difference between these two values, which is the unfunded pension liability.

As can be seen (4), Santa Clara County and the City of Sacramento have only 77 percent funded pension accounts, and the City of Costa Mesa’s pension account is only 70 percent funded. Because of this, in addition to their regular ongoing payments to the pensions system to fund pension benefits as they are earned, these employers have to make catch-up payments to reduce their unfunded pension liability.

The next section of the chart depicts and quantifies these two types of contributions that agencies must make to their pension system. The so-called “Normal Contribution” (5) is how much money has to be paid to the pension system and invested each year to yield sufficient funds to eventually pay the additional pension benefits earned by active employees in that year. As can be seen (7), the employers – i.e., the taxpayers – pay about two thirds of the normal contribution. The PEPRA reform requires employees to pay half of the pension cost through payroll withholding, but, again, PEPRA only affects those hired after 2013. This means that in a few decades the taxpayer share of the normal contribution will come down to 50 percent.

The “unfunded contribution,” next on the chart (8), is what cities and counties have to pay to reduce their unfunded liability. For that amount, no employee contribution is required. The employer has to pay 100 percent of it. As can be seen, in all cases the unfunded contribution is far more than the normal contribution (row 8 compared to row 6). This means the employer share of the total contribution to CalPERS (normal and unfunded payments combined) is 79 percent of Santa Clara County’s total pension payment obligation, 82 percent of Sacramento’s, and 88 percent of Costa Mesa’s (row 10).

The impact of this burden can be put in context when considering how much these costs add to an agency payroll. The total employer payment for their pensions adds 29 percent to payroll costs in Santa Clara County, 38 percent in Sacramento, and a whopping 67 percent in Costa Mesa (11).

The Opportunity Cost

Another useful perspective from which to evaluate just how much pensions are costing taxpayers would be to consider the impact of transitioning every public employee to Social Security. At a cost to the employer of 6.2 percent of payroll, Santa Clara County would save 543 million per year, Sacramento would save $128 million, and the City of Costa Mesa would save $32 million. Why is this a far fetched scenario? Isn’t Social Security what private sector taxpayers must rely upon for their retirement security?

To take this one step further, even if along with the Social Security payment, you added an additional 6.2 percent of salary to be the employer’s contribution to each employee’s 401K – a level of generosity rarely found in the private sector – taxpayers would still save, per year, $399 million in Santa Clara County, $103 million in Sacramento, and $29 million in Costa Mesa.

It is fair to wonder how far $399 million would go towards repairing the roads in Santa Clara County, which are ranked, using data from the Federal Highway Administration, among the roughest in the nation. One might also consider how that money could be invested in more law enforcement, when violent crime has increased for the past two years in a row in Santa Clara County.

In the City of Sacramento, investing another $103 million in basic law enforcement would go a long way towards curbing violent crime in that city, where homicides were up over 30 percent in 2021 compared to 2021, and are on track in 2022 to exceed that. How many shelter beds could $103 million buy, as the homeless count in Sacramento County – most of them concentrated in the City of Sacramento – nearly doubled between 2019 and 2022? As it is, Sacramento’s projected $153 million outlay for pension contributions to CalPERS is more than they will spend on all of their capital improvement programs this year.

Costa Mesa might only save $29 million by replacing defined benefit pensions with a combination of Social Security and an exceedingly generous 401K plan, but with only 110,000 residents, Costa Mesa isn’t a very big city. The city’s general fund budget for 2022-23 is only $163 million. Saving $29 million would add 17 percent back to the city’s budget to tackle other challenges.

It is easy enough to criticize how California’s public agencies would spend the money they could save by adopting more equitable and financially sustainable retirement benefits. Current homeless policies tend to make the problem worse when more money is spent. More spending on law enforcement is wasted if criminals aren’t held accountable. Scandalous waste of public funds on road improvement projects is a perennial problem. But these examples of waste don’t obviate the fact that pension commitments have swamped civic budgets. While we’re fighting waste at city hall, we can give the savings on pensions back to the taxpayers.

Pension systems in California’s state and local government agencies today have achieved a precarious stability, thanks in part to PEPRA, and for the most part thanks to dramatically higher contributions demanded, and gotten, from taxpayers. But this stability has come at a terrific price in the form of lost opportunities for these agencies to better serve the public.

An edited version of this article was published by the Pacific Research Institute.