Public Servant Who Made $327,491 in 2017 Asks Us to Support Higher Taxes

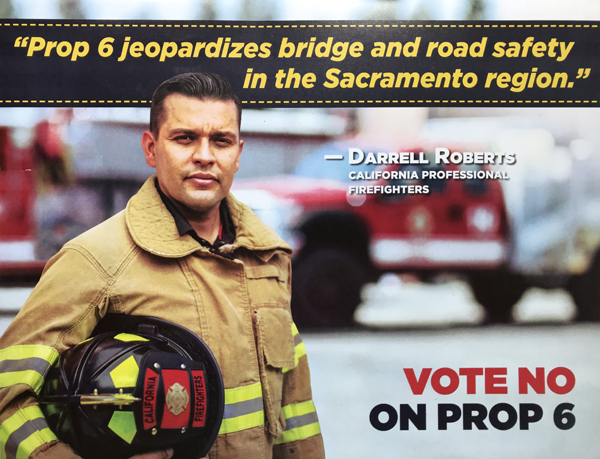

Every two years, around this time, political mailers inundate the mailboxes of California’s registered voters. This week, many Sacramento residents received “Vote No on Prop 6″ mailer. Prop 6 is that pesky, subversive citizens ballot initiative that, if approved by voters, will roll back the gas tax.

But Prop. 6 isn’t the topic here. Rather, the topic is all taxes in California. Why is there relentless pressure to increase them? And what special interests are paying for these campaigns to increase (or preserve) taxes across California?

In that context, this No on Prop. 6 mailer is instructive. Because blazoned across the cover of this four page, 8.5″ x 11” glossy full color flyer, is Darrell Roberts, representing the California Professional Firefighters. Roberts is the president of IAFF Local 2180, the Chula Vista Firefighters Union. In addition to his duties as president of Local IAFF Local 2180, Roberts is a Fire Battalion Chief for the Chula Vista Fire Department. In that capacity, he earned $327,491 in 2017, including $99,887 of overtime.

Now let’s back up for just a moment and make something perfectly clear. This isn’t about disrespecting firefighters in general, or Mr. Roberts in particular. Quite the contrary. Firefighters perform dangerous, challenging jobs that require years of intense training. Every year in California, a few of them die in the line of duty. In some years, more than a few. Furthermore, firefighters constantly witness trauma, often horrific, every time they respond not only to fires, but medical emergencies and automobile accidents. Their jobs are tough.

For these reasons, critics of public sector compensation trends should always temper their observations with respect. It is far too easy to observe, accurately, that many other jobs carry higher risk of injury or death, while forgetting that first responders stand between citizens and mayhem not just in normal times, but also in extraordinary times. In a truly cataclysmic event, and 911 is a perfect example, firefighters are obligated to occupy the front lines. They are the ones who must stop whatever destructive storms afflict our society. They are the ones who must go in before safety is restored, and rescue the stranded victims.

With that necessary preamble, and without diminishing it in any way, a difficult conversation remains necessary regarding public sector compensation, and the political power of the public sector unions who push for continuous increases in compensation.

A California Policy Center analysis published nearly two years ago, using 2015 data, calculated the average pay and benefits for a California firefighter at $196,370 for those employed by cites, $198,959 for those working for counties, and $145,938 for those working for the state. Those averages have not fallen in the past three years, and they do not include the additional cost per firefighter, if and when their retirement pensions are adequately funded.

Mr. Robert’s own City of Chula Vista provides an example of these rising pension costs. In 2017 the average pay for a Chula Vista firefighter was $189,715. That included, on average, $41,112 for overtime and $31,381 for employer contributions to their defined benefit pensions. But as they say, you ain’t seen nothin’ yet.

Using CalPERS own projections for the City of Chula Vista, the average normal contribution by the city to fund police and firefighter pensions is expected to grow from 20 percent of payroll in FYE 6/30/2017 to 22 percent of payroll by FYE 6/30/2025. Nothing terribly dramatic there. But, get this, the so-called unfunded contribution – that additional amount necessary to pay down the city’s unfunded liability for police and firefighter pensions – is expected to grow from 13 percent of payroll in FYE 6/30/2017 to 32 percent of payroll in 6/30/2025.

Put another way, the City of Chula Vista’s employer payments for public safety pensions are going to go from 33 percent of payroll to 53 percent of payroll by 2025. And if the stock market decides to end its already record breaking bull run, harming the CalPERS investment portfolio, these payments will go much higher.

It’s also important to recognize the relationship between excess overtime expenses and the cost of pension and health benefits (including retirement health benefits). When public employers pay more than 50 percent above regular salary to fund pensions and benefits, and in the case of public safety, they do, then it makes financial sense to pay time-and-a-half to existing staff, since that will cost less. Lost in that equation is the stress this excessive overtime inflicts on overworked personnel, as well as the lost opportunity to bring benefit overhead back below fifty percent.

Collectively California’s state and local employers, based on projections already released from CalPERS, are going to have to increase their total contributions to public employee pension funds from approximately $31 billion in 2017 to an estimated $59 billion by 2025.

Maybe veteran firefighters truly believe they are entitled to annual pay and benefits packages in excess of $200,000 per year, or in Mr. Roberts case, in excess of $300,000 per year. But with all the political power these unions wield, they ought to be thinking of ways to help lower the cost-of-living in California. That would help everyone.

And perhaps it may disturb even the most respectful and appreciative among us, when a public servant who made $327,491 last year, asks us to support higher taxes.

* * *

Sources:

2017 Salaries for Chula Vista – Transparent California

California’s Public Sector Compensation Trends – California Policy Center, January 2017

Comprehensive Annual Financial Report, FYE 6/30/2017 – City of Chula Vista

Safety Plan of the City of Chula Vista, Annual Valuation Report as of 6/30/2017 – CalPERS

Miscellaneous Plan of the City of Chula Vista, Annual Valuation Report as of 6/30/2017 – CalPERS

2017 City Data, Government Compensation in California – California State Controller

California Government Pension Contributions Required to Double by 2024 – California Policy Center, January 2018