Martin F. Lueken, Ph.D.

Director of the Fiscal Research and Education Center, EdChoice

in collaboration with

Lance Christensen

Vice President of Education Policy, California Policy Center

Martin F. Lueken, Ph.D.

Director of the Fiscal Research and Education Center, EdChoice

in collaboration with

Lance Christensen

Vice President of Education Policy, California Policy Center

Article IX of the California Constitution strongly supports education. It begins with a clear statement: “A general diffusion of knowledge and intelligence being essential to the preservation of the rights and liberties of the people, the Legislature shall encourage by all suitable means the promotion of intellectual, scientific, moral, and agricultural improvement.” The constitution also directs the Legislature to establish a system of free public schools in each district. However, it offers little guidance on curriculum and administration, leaving much of that to the Education Code.

Originally, the constitution did not require taxpayer dollars to fund public schools or force students to attend their local schools. Early public education in California started with churches and charitable organizations educating the population before the government established the current public school system.

In 1879, the California Constitution was amended to include the Blaine Amendments, which barred taxpayer funds from supporting religious K-12 schools. However, the U.S. Supreme Court later ruled these amendments unconstitutional in cases like Espinoza v. Montana and Carson v. Makin, stating that if a state funds private education, it cannot exclude religious schools.

State and federal governments already fund private religious colleges through grants, so it should be the same for K-12 education.

Many education advocates admit that public schools are failing. Parents want more options for their children’s success. The California Policy Center (CPC) was created to offer these choices, supporting charter schools, homeschooling, and microschools, and pushing for competition to improve public education.

While most K-12 students attend traditional public schools, charter, private, and homeschool enrollments have surged recently. Since 2019, California’s K-12 enrollment has declined as families move out of state or choose private or homeschool options.

An Educational Savings Account (ESA) sets aside state funds for K-12 education that parents can use for private school or homeschooling if partnered with an accredited school. These funds can cover tuition, books, supplies, tutoring, testing fees, special needs services, and transportation. Any leftover funds can be used for vocational or higher education after high school.

Parents who cannot afford alternatives to public schools should have access to resources like ESAs, which allow money to follow the child to the education provider of their choice.

CPC has long supported ESAs. After the legislature rejected a 2018 bill to create ESAs, CPC joined a coalition to push for an ESA ballot initiative in 2021. Unfortunately, the influence of the state’s many teachers’ unions was a serious roadblock to accomplishing such a reform.

Despite this, other states have created universal ESAs for K-12 students, recognizing that taxpayers already fund early childhood and higher education. ESAs give parents more options for their children’s education.

Critics argue that ESAs take money from public schools, but when parents move or choose private schools, public schools lose funding anyway. ESAs allow funds to follow the child to the best educational environment. California’s funding protection policy provides additional support that allows more time for districts to adapt.

ESA programs ultimately result in massive tax savings for taxpayers while producing better academic outcomes for students who participate in the choice program as well as those students who remain in public schools. The recurring argument against ESA programs that they take away funding and resources from public schools has been disproven time and again by empirical research of choice programs around the country. Often, the level of resources that districts have for fewer students on a per-pupil basis will increase as a common byproduct of choice programs.

An ESA alternative in California would benefit students at every grade level with no detrimental effect on traditional public schools thanks to the state funding formula that would protect school districts from negative fiscal impacts for several years to allow districts to address shifts in enrollment.

This study aims to address the fiscal concerns of earnest opponents and demonstrate that a well-designed ESA program could save the state money and improve education outcomes for many of California’s 5.8 million students who feel underserved by public schools.

CPC is pleased to publish this report in collaboration with Martin F. Lueken, Ph.D., the Director of the Fiscal Research and Education Center at the educational nonprofit EdChoice. We would also like to thank E3 – Excellent Education for Everyone – a research and policy nonprofit working to improve K-12 education and increase educational options for children and Lew Andrews founder, president and chair of the Kids’ Scholarship Fund. Without their support, this report would not have been possible.

We hope policymakers will consider how to better empower parents in their children’s education while fulfilling their responsibility to taxpayers by seriously considering the benefits of ESAs.

-Lance Christensen, Vice President of Educational Policy and Government Affairs at the California Policy Center

Currently, 33 states are using 75 private educational choice programs that allow families to receive a portion of their child’s per-pupil funding for K–12 education to access schools and other educational services outside the public system. Although California currently does not have a private educational choice program, 70% of California residents and 76% of California school parents support these policies.

Since the Covid pandemic, the scope of these programs expanded significantly, leading some people to describe this period as a watershed moment and dubbing 2023 the year of universal choice. This is because eight states enacted universal or near-universal choice programs last year. West Virginia led the charge by passing a near-universal education savings account (ESA) program. Arizona soon followed by expanding its ESA program to every K–12 student in the state. Florida, Indiana, Iowa, North Carolina, Ohio, Oklahoma, and Utah now allow all or almost all (more than 90%) of its K–12 population to access a portion of their public funding and decide how to spend it on their education. With Alabama and Louisiana passing universal choice bills in 2024, the tally as of this writing is 12 states that have universal or near-universal education choice programs.

Although California has some education choice that provides some families alternative educational schooling options in the form of charter schools and open enrollment, it does not have any form of private education choice programs such as an educational savings account, voucher, or tax-credit scholarship program. Education choice is a mechanism for publicly funding a child’s education. As such, these programs generate fiscal effects for different categories of taxpayers and public school districts. Therefore, the state’s fiscal health will be an important consideration for some stakeholders.

The state ranks 42 out of 50 states in fiscal health, exceeding $240 billion in unfunded liabilities which breaks down to $18,600 per taxpayer. In light of California’s ongoing budgetary challenges, this paper analyzes the potential fiscal impact of different near-universal education choice models in California. Ultimately, the fiscal impact of a choice program is a matter of design, and the Golden State can do more to increase education options for families without detrimentally impacting the state’s fiscal health.

A large body of research examines the effects of educational choice programs on a variety of outcomes. This research indicates that educational choice programs generate fiscal benefits for taxpayers. Random assignment studies on the effects of choice programs on participant test scores find positive results, with a few exceptions. Choice programs also benefit students who remain in public schools by boosting their learning gains, reducing absenteeism, and decreasing suspension rates. Research also finds evidence that students who participate in choice programs are more likely to graduate from high school, more likely to enroll in college, and more likely to persist in college. Studies also find an association between increased public and private educational options and reduced criminal activity. Researchers also find a link between increased educational options and increasing students’ tolerance for the rights of others, civic knowledge and participation, volunteerism, and other civic outcomes.

Given the surge in states introducing and expanding ESA programs, this paper conducts a fiscal analysis of three model ESA programs in California. ESAs involve the allocation of public funds into authorized savings accounts for families. Families can use these funds for various education-related costs such as private school fees, online learning courses, specialized therapies for students with needs, educational materials like textbooks, private tutoring, community college fees, higher education expenses, and other approved personalized learning services and resources. In some instances, unused funds can be carried over from one year to the next, enabling families to save for future educational needs, including college expenses.

The analysis estimates the short-run and long-run fiscal effects of ESA programs in California under these three models:

The analysis uses a range of assumptions for the take-up rate and the switcher rate. The take-up rate is the percentage of eligible students who participate in the program. The switcher rate is the percentage of ESA students who are switchers, or students who would enroll in a public school without financial assistance from the ESA program. Switchers offset some or all of the cost of the ESA program because the state does not support their education in the public school system when they are in the ESA program.

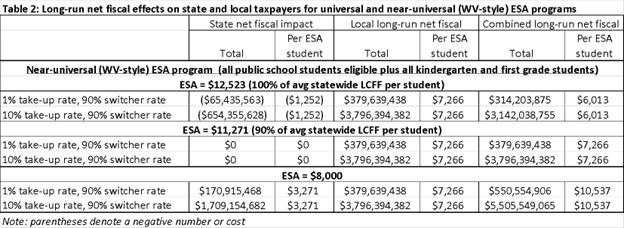

Under Model 1 (near-universal program, ESA is worth 100% of the statewide average LCFF per student) and assuming a 1% take-up rate and 90% switcher rate:

The state net fiscal impact is a net cost of $65.4 million, or $1,252 per ESA annually. The local net fiscal impact is between $11.4 million and $431.2 million in savings, or $219 to $8,253 per ESA. The combined net fiscal impact is between $54.0 million in net cost and $365.8 million in net savings, or $1,033 to $7,000 per ESA.

Short-run net fiscal effects

Long-run net fiscal effects

Under Model 2 (near-universal program, ESA is worth 90% of the statewide average LCFF per student) and assuming a 1% take-up rate and 90% switcher rate:

The state net fiscal impact is zero. The local net fiscal impact is between $11.4 million and $431.2 million in savings, or $219 to $8,253 per ESA. The combined net fiscal impact is between $11.4 million and $431.2 million in savings, or $219 to $8,253 per ESA.

Short-run net fiscal effects

Long-run net fiscal effects

Under Model 3 (near-universal program, ESA is worth $8,000 per student) and assuming a 1% take-up rate and 90% switcher rate:

The state net fiscal impact is $170.9 million in net savings annually. The local net fiscal impact is between a net cost of $22.8 million and net savings worth $379.6 million, or $436 to $7,266 per ESA. The combined net fiscal impact is between $148.1 million and $550.6 million in savings, or $2,835 to $10,537 per ESA.

Short-run net fiscal effects

Long-run net fiscal effects

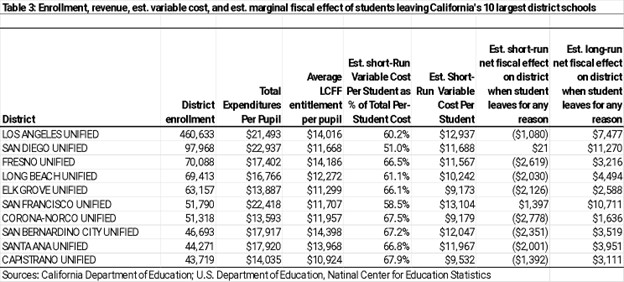

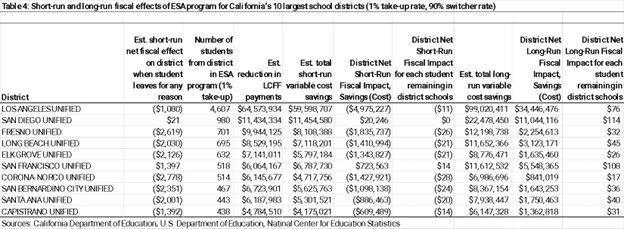

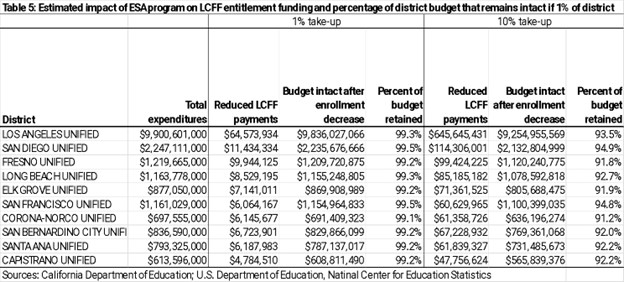

The analysis also provides data on the state’s largest ten public school districts that estimates the short-run and long-run fiscal impact on those districts when students leave for any reason. Because both revenue and costs fluctuate when enrollment changes, the short-run net fiscal impact on individual school districts when students leave for any reason is determined by the relationship between its reduction in revenue and its short-run variable costs. The long-run net fiscal impact is the relationship between a district’s reduction in revenue and its total costs.

The state’s school funding formula has a funding protection in place for school districts that experience enrollment declines. Under this protection, LCFF allocations for districts are determined by the higher of the district’s current year ADA or the average ADA of the prior three years. This provision acts to mitigate the impact of any revenue decline due to enrollment loss and allows districts more time to adjust their operations.

Without the funding protection in place, eight of the ten largest school districts would experience net fiscal costs in the short run if students leave to participate in an ESA program, or if students choose to leave for any other reason. However, the LCFF allocations protect each district from those fiscal impacts.

In the long run, each district can eventually fully adjust for a reduction in revenue from a given decrease in enrollment. These districts will experience net fiscal benefits in the long term if students leave to participate in an ESA program, or if students choose to leave for any other reason.

If one percent of public school students in the Los Angeles Unified School District left for any reason, the district would experience an estimated $5 million in short-run net costs, or 0.05% of the district’s $9.9 billion in total expenditures. For this migration of students, 99.3 percent of the district’s budget would remain intact.

In the long run, LAUSD would experience $35 million in net fiscal benefits if one percent of students leave for any reason.

More than one million students in 33 states, Washington D.C., and Puerto Rico are using 75 private educational choice programs that allow families to receive a portion of their child’s per-pupil funding for K–12 education to access schools and other educational services outside the public system.[1] Although California currently does not have a private educational choice program, 69% of California residents and 76% of California school parents support these policies.[2]

Since the Covid pandemic, the scope of these programs expanded significantly, leading some people to describe this period as a watershed moment and dubbing 2023 the year of universal choice.[3] This is because eight states enacted universal or near-universal choice programs last year. West Virginia led the charge by passing a near-universal ESA program. Arizona soon followed by expanding its ESA program to every K–12 student in the state. Florida, Indiana, Iowa, North Carolina, Ohio, Oklahoma, and Utah now allow all or almost all (more than 90%) of its K–12 population to access a portion of their public funding and decide how to spend it on their education. With Alabama and Louisiana passing universal choice bills in 2024, the tally as of this writing is 12 states that have universal or near-universal education choice programs.

Although California has some education choice that provides some families alternative educational schooling options in the form of charter schools and open enrollment, it does not have any form of private education choice programs such as an educational savings account, voucher, or tax-credit scholarship program. Education choice is a mechanism for publicly funding a child’s education. As such, these programs generate fiscal effects on different taxpayers and public school districts. Therefore, the state’s fiscal health will be an important consideration for some stakeholders.

The state ranks 42 out of 50 states in fiscal health, with a taxpayer burden of $18,600 and unfunded liabilities exceeding $240 billion.[4] In light of California’s ongoing budgetary challenges, this paper analyzes the potential fiscal impact of different near-universal education choice models in California. Ultimately, the fiscal impact of a choice program is a matter of design. The Golden State can do more to increase education options for families without detriment to the state’s fiscal health.

Types of Private Educational Choice Programs

There are four main types of private educational choice programs: education savings accounts (ESAs), vouchers, and tax-credit scholarships.

Education savings accounts (ESAs) involve the allocation of public funds into authorized savings accounts for families. Families can use these funds for various education-related costs such as private school tuition or fees, online learning courses, specialized therapies for students with needs, educational materials like textbooks, private tutoring, community college fees, higher education expenses, and other approved personalized learning services and resources. In some instances, unused funds can be carried over from one year to the next, enabling families to save for future educational needs, including college expenses.[5]

School voucher programs empower families to select a private school for their children, utilizing either the entirety or a portion of the public funding designated for their children’s education. These programs redirect the funds usually allocated for a school district directly to participating families through vouchers, which can cover either full or partial tuition costs at private schools, encompassing both religious and non-religious educational institutions.[6]

Tax-credit ESAs enable taxpayers to receive either full or partial tax credits upon donating to nonprofit organizations responsible for financing and overseeing parent-directed K–12 education savings accounts. These funds can be utilized by families to cover diverse education-related costs like private school tuition, online learning programs, private tutoring, community college expenses, higher education fees, approved customized learning resources, and the option to carry over unused funds for future educational needs. While not all tax-credit ESAs offer this, some even permit students to use these funds for a blend of public school courses and private services.[7]

Tax-credit scholarship programs allow taxpayers to receive full or partial tax credits when they donate to nonprofits that provide private school scholarships. Eligible taxpayers can include both individuals and businesses.[8]

A New Era of Choice?

All choice programs passed before the pandemic are restricted in various ways and to different degrees. Most programs restrict eligibility to certain groups of students such as special needs or low-income students. Others restrict funding by imposing funding caps. Post-pandemic, however, the popularity of universal and near-universal programs is growing, evidenced by the number of states that introduced educational choice bills and the onset of universal and near-universal choice programs. Indeed, the pandemic ushered in a new era of educational choice, with 2023 representing a landmark year. According to EdChoice’s publication The ABC’s of School Choice:

“Policymakers in 40 states debated 111 educational choice bills—79 percent of which related to ESAs. As the months ticked by, a total of seven states enacted new choice programs and 10 expanded ones already in operation. As of this writing, eight states have joined Arizona and West Virginia in offering all students choice, making 2023 the Year of Universal Choice. With the release of this latest edition of The ABCs of School Choice, approximately 20 million students—or 36 percent—are now eligible for a private choice program.”[9]

Although these programs enjoy high popularity among the general public and parents, they continue to face stiff opposition from various groups and organizations like teachers’ unions and public school advocacy groups. One of the most commonly purported concerns about choice programs is that they “drain” or “siphon” resources from public schools when students leave public schools to participate in these programs. To help address this concern, this paper presents a fiscal analysis and discusses the potential fiscal effects of introducing private educational choice in the Golden State.

This paper proceeds as follows. The next section discusses the tradeoffs between universal-type choice programs and more targeted programs. It then summarizes the body of fiscal analyses and other research on private educational choice programs. The section after provides an overview of school funding in California, followed by a discussion of the methods used for estimating the potential fiscal effects of education savings accounts in California. The paper finally summarizes the results of the analysis and concludes.

[1] Alli Aldis (2024), “One Million Students in School Choice Programs, By the Numbers,” EdChoice, June 18, https://www.edchoice.org/engage/one-million-students-in-school-choice-programs-by-the-numbers/

[2] EdChoice Public Opinion Tracker, updated March 14, 2024, https://edchoice.morningconsultintelligence.com/reports/california.pdf

[3] Mike McShane (2023), “Oh, What A Year (For School Choice)”, Forbes, December 19, https://www.forbes.com/sites/mikemcshane/2023/12/19/oh-what-a-year-for-school-choice/?sh=5bed5fe644f9

[4] Truth in Accounting (2023), Financial State of the States 2023, University of Denver, Daniels College of Business, School of Accountancy, https://www.truthinaccounting.org/library/doclib/FSOS-Booklet-2023.pdf

[5] Source: EdChoice, “Types of School Choice,” accessed 12/30/2023 from https://www.edchoice.org/school-choice/types-of-school-choice/.

[6] Ibid.

[7] Ibid.

[8] Ibid.

[9] EdChoice (2023), The ABCs of School Choice: The comprehensive guide to every private school choice program in America, 2024 Edition, p. 3, https://www.edchoice.org/wp-content/uploads/2023/11/2024-ABCs-of-School-Choice.pdf

Universal and near-universal choice programs are increasingly becoming popular among parents, policymakers, and other stakeholders. There is a financial balance to consider when deciding who can use an ESA program. If the program only allows students who were already in public schools, it saves more money because those students leaving public schools reduce costs. But if the program is open to everyone, including those already in private or homeschool, it costs more since there are no savings from those students. While the fiscal benefits from choice programs may be important for some people, there are many reasons for considering broader programs which may generate lower levels of fiscal benefits.

Certain individuals argue that choice policy should primarily concentrate on narrowing the disparities between privileged and underprivileged students. Consequently, they propose specialized programs that cater to families residing in economically challenged areas, those with low incomes, or students attending underperforming schools. Critics and some proponents of choice contend that broadly inclusive programs would essentially provide financial aid to affluent families who do not require assistance. This “targeted” strategy, however, could potentially overlook the opportunity to support genuinely disadvantaged families who may otherwise not know that they are eligible for more school choice options, preventing substantial systemic change.[1]

Milton Friedman, a Nobel laureate in economics, asserted that implementing universal choice would motivate entrepreneurs to enter the K–12 industry, thereby stimulating innovation.[2] While a focused approach might effectively fill vacant spots in private schools with students, a universal choice system would generate fresh and innovative educational avenues. Friedman contended that targeted vouchers, although helpful for assisting the disadvantaged, would not bring about substantial reform in the educational system. He advocated for a genuine reform that universal choice could facilitate by giving every parent and their child a choice in school whether they had the needed funding or not.[3]

More targeted programs tend to face greater challenges in political sustainability due to their limited constituency and reduced political influence in defending the program. An illustration of this is the District of Columbia Opportunity Scholarship Program, which has offered scholarships to low-income families for 17 years and has often been targeted by unions and other critics of private school vouchers during much of that time.[4]

Choice programs that limit participation by requiring students to enroll in a public school prior to participating in a program may also generate incentives for churn. That is, families with children already accessing a learning environment outside of the public school system pull their children out of their current school and enroll him or her in a public school in order to access the choice program. This arrangement can be a non-starter for students who left the public school system in the first place, perhaps either due to bullying or to access specialized services. Requiring families to put their children in a situation they were escaping from in the first place, so they can access a choice program, creates a heavy burden for these families.

EdChoice polling suggests that universal choice programs enjoy more significant backing compared to targeted programs. According to the 2023 Schooling in America Survey, 76% of respondents supported the idea that “ESAs should be available to all families, regardless of income and special needs,” whereas 54% agreed that “ESAs should be available only to families based on financial need.” Support has trended upward since 2015.[5]

Education choice programs have been around for decades, long enough for researchers to produce a large body of knowledge about how these programs work. The next section discusses research on the fiscal effects and academic effects of these programs.

[1] EdChoice (not dated). EdChoice Policy Toolkit. Eligibility and Scale: Universal or Targeted? Retrieved from: https://www.edchoice.org/wp-content/uploads/2019/12/1_footnote.pdf

[2] Milton Friedman. “Public Schools: Make them Private.” The Washington Post, February 19, 1995, https://www.washingtonpost.com/archive/opinions/1995/02/19/public-schools-make-them-private/5d5c9c9b-675e-451b-b106-6d9ba6dad2d1/

[3] Milton Friedman and Nick Gillespie (2006). “The Father of Modern School Reform,” Hoover Digest, Hoover Institution, January 30, https://www.hoover.org/research/father-modern-school-reform

[4] Editorial Board. “Why are unions and Democrats so opposed to giving poor children a choice in schooling?” The Washington Post, July 13, 2021, https://www.washingtonpost.com/opinions/2021/07/08/save-dc-private-school-voucher-program-unions/

[5] EdChoice, 2023 Schooling in America Survey (conducted April 18–May 2, 2023), Q24, https://www.edchoice.org/what-we-do/research/schooling-in-america-polling-dashboard-2/

There have been 75 analyses of the fiscal effects of educational choice programs currently operating in the United States. These fiscal analyses, which account for both programs’ costs and savings, comprise three ESA programs, 24 voucher programs, and 18 tax-credit scholarship programs in 23 states and Washington, D.C. Of these studies, 69 found programs generated net savings for taxpayers, five found programs were cost-neutral, and five found programs generated net costs.[1]

These analyses include a national study of the fiscal effects of 40 educational choice programs on state and local taxpayers combined.[2] Through FY 2018, these programs generated net fiscal benefits estimated from $12.1 billion to $27.8 billion, or between $3,200 and $7,400 per student participant. In other words, these programs generated between $1.80 and $2.80 in fiscal savings for each dollar spent on these programs, on average. The present analysis uses methods based on this study.

There has also been analysis on the potential fiscal effects of different ESA models in Connecticut, New Jersey, and New York.[3] The key takeaway from these analyses is that the fiscal effects of any choice program will depend on the design of the program itself. Key factors include the per-pupil funding for the choice program relative to funding for educating the student in the public school system, the program’s participation rate, and the portion of participating students who are switchers. Switchers are students in a choice program who would have enrolled in a public school without financial assistance from the choice program. They generate savings for taxpayers because they are no longer enrolled in public schools – state funding is reduced for their assigned public school, and educational costs decrease for the public school.

In Connecticut, an ESA worth $5,000 would produce overall net short-run fiscal benefits for state and local taxpayers estimated at $7,500 per ESA student, or $77 million, assuming 2% of eligible students participated in the program and all those students switched from public schools. In New Jersey, an ESA worth $6,500 would produce net short-run fiscal benefits for state and local taxpayers estimated at $7,300 per ESA student, or nearly $100 million, assuming that 1% of eligible students participated in the program and all those students switched from public schools. In New York, an ESA worth $6,500 would produce net fiscal benefits for state and local taxpayers estimated at $11,200 per ESA student, or $300 million, assuming that 1% of eligible students participated in the program and all participating students switched from public schools.

Fiscal outcomes represent just one outcome that researchers have documented. Researchers have also examined the effects of private educational choice programs on the academic outcomes of students who participate in them and students who choose to remain in the public school systems.

The Effects of Educational Choice

In 1990, Wisconsin launched the Milwaukee Parental Choice Program, the first modern day voucher program in the United States.[4] Programs slowly expanded until 2011, when the rate of growth for these programs increased and the first ESA programs were introduced. Today, 17 ESA programs operate in 15 states. Stakeholders are usually concerned with the impacts that these programs have on both students who participate in them and public schools. This section discusses the research on the academic effects of these programs for those students.

A considerable body of research analyzes the effects of choice programs on students who participate in them and on students who remain in public schools. With a few exceptions, results from these studies are mostly positive to neutral.

A recent study by economist David Figlio, Casandra Hart, and Krzysztof Karbownik examined the effects of expanding funding and eligibility in the Florida Tax Credit Scholarship Program on public school students. Their results suggest that when states expand educational opportunities for their families, students who remain in public schools benefit by experiencing gains in academic outcomes. Furthermore, they documented that public school students experienced reduced absenteeism and lower suspension rates. While effects are positive overall, these effects are more pronounced for low-income students.[5]

Researchers have also studied a number of other outcomes. Studies find evidence that students who participate in choice programs are more likely to graduate from high school, more likely to enroll in college, and more likely to persist in college.[6] Studies also find an association between increased public and private educational choice and reduced criminal activity.[7]

Research also finds a link between increased educational options and increasing students’ tolerance for the rights of others, civic knowledge and participation, volunteerism, and other civic outcomes.[8] A recent meta-analysis by a team of researchers from the University of Arkansas studied the relationship between private schooling and measures of political tolerance, political participation, civic knowledge and skills, and voluntarism and social capital. This team estimated that private schooling, on average, boosted any civic outcome by 0.055 standard deviations relative to public schools. This finding suggests that “educational pluralism seems to be a boon, and not a bane, for civic outcomes.”[9]

Random assignment is considered the “gold standard” for research methods in social science. Students in one group were randomly selected to receive a scholarship (the “treatment” group) while students in the other group were randomly denied participation in the choice program (the “control” group). This research design is considered the most rigorous method because it limits selection bias. Selection bias occurs when individuals in certain groups in a population are more likely to be included or excluded in a study sample. For example, parents that are more motivated or parents with children who face problems in their schools such as bullying may be more likely to participate in a choice program than parents less motivated or whose children do not experience similar problems in their current schools. Random assignment ensures that the comparison groups in a study are identical, on average, across relevant factors with one exception: one group receives scholarships while the other group does not.

Seventeen random assignment studies examined the effects of choice programs on participant test scores. Eleven of those studies estimated benefits overall to participant test scores for either the full sample or at least one subsample of students. Four studies did not detect any effect for any group of students. Two studies on the Louisiana Choice Scholarship Program (LSP) estimated large negative effects for students participating in that program.[10]

Researchers document that Louisiana’s voucher program is the most regulated choice program in the country.[11] Benjamin Scafidi and Jonathan Butcher note:

“The Louisiana scholarship program requires recipients to take the same tests that public school students take at the end of each school year. This regulation is problematic because these state tests are aligned with public school academic content standards for each grade and subject, and private school educators do not teach to these content standards. Private school students, then, are at a disadvantage, as they do not learn the same content at the same time as public school students. There is no evidence that private school academic standards are less rigorous than public school standards. In fact, the evidence… regarding the effects of education choice on students’ academic attainment suggests that private schools hold their students to higher academic standards than public schools.”[12]

A meta-analysis by a team of researchers at the University of Arkansas estimated the overall effects of private school choice programs globally. Estimates of the most recent year of treatment in the studies of programs in the U.S. indicate that students in these programs experienced positive gains on reading and math test scores. The authors note that “analyses based on the most recent year are considered more policy relevant than earlier results, as stakeholders may have changed their behavior in response to vouchers.”[13] They also observe that “the longer a sample of voucher students has been treated, the larger and more positive the achievement effects tend to be.”[14]

Two nonexperimental studies on voucher programs in Indiana and Ohio used matching methods and found negative effects for math and reading test scores.[15] In contrast, a longitudinal evaluation of Milwaukee’s voucher program that also employed matching methods to study test score effect found no significant effect on math scores and significant positive effects on reading.[16] Matching methods are not as effective as randomized experiments in controlling for self-selection bias. The limitation with matching studies is that they ostensibly compare outcomes between two groups that are not comparable – one group made a choice to participate in a choice program while the other group chose not to participate. There is something different about the choosers that researchers cannot observe, measure, and control which may lead to bias in the estimates.

A body of research also examines the effects of choice programs on students who remain in public schools. Of 29 studies on 11 programs in eight states, 26 found positive effects of choice programs on test scores of students who remain in public schools, one found no effect, and two found negative effects.[17] Numerous other systematic reviews conclude that choice programs tend to induce public schools to improve outcomes for the students who remain.[18] Furthermore, a meta-analysis conducted by a team of researchers concluded, “In general, competition resulting from school choice policies does have a small positive effect on student achievement. The lack of an overall negative impact on student outcomes might ease critics’ concerns that competition will hurt those students ‘left behind’ due to school-choice policies.”[19]

The next section discusses school funding for California’s public school systems.

[1] EdChoice (2024), The 123s of School Choice: What the Research Says about Private School Choice Programs in America, 2024 edition, retrieved from: https://www.edchoice.org/wp-content/uploads/2024/06/123s-2024.pdf

[2] Martin F. Lueken (2021). The Fiscal Effects of School Choice: Analyzing the costs and savings of private school choice programs in America, EdChoice, retrieved from: https://www.edchoice.org/wp-content/uploads/2021/11/The-Fiscal-Effects-of-School-Choice-WEB-reduced.pdf

[3] Lewis M. Andrews (2017). Education Savings Accounts: Empowering Kids and Saving Money in Connecticut, Yankee Institute, retrieved from: https://yankeeinstitute.org/wp-content/uploads/2017/10/Yankee-Study-ESA-Study-2017-no-marks-1.pdf; Martin Lueken (2020). Fiscal Analysis of an Education Savings Account Program in New Jersey, EdChoice, retrieved from: https://www.edchoice.org/research-library/?report=fiscal-analysis-of-an-education-savings-account-program-in-new-jersey; Martin F. Lueken (2021). Education Savings Accounts: How ESAs Can Promote Educational Freedom for New York Families and Improve State and Local Finances, Manhattan Institute, retrieved from: https://manhattan.institute/article/education-savings-accounts-how-esas-can-promote-educational-freedom-for-new-york-families-and-improve-state-and-local-finances

[4] Maine and Vermont have the oldest school voucher programs, dating back to 1869.

[5] David N. Figlio, Cassandra M. D. Hart, and Krzysztof Karbownik (2023), Effects of Maturing Private School Choice Programs on Public School Students, American Economic Journal: Economic Policy, 15(4), pp. 255–294, https://www.aeaweb.org/articles?id=10.1257/pol.20210710

[6] Leesa M. Foreman (2017), Educational Attainment Effects of Public and Private School Choice, Journal of School Choice, 11(4), pp. 642–654, https://dx.doi.org/10.1080/15582159.2017.1395619

[7] Corey DeAngelis and Patrick J. Wolf (2019), Private school choice and crime: Evidence from Milwaukee, Social Science Quarterly, 100(6), pp. 2302-2315, https://doi.org/10.1111/ssqu.12698; Corey DeAngelis and Parick J. Wolf (2020), Private School Choice and Character: More Evidence from Milwaukee, Journal of Private Enterprise, 35(3), pp. 13-48, http://journal.apee.org/index.php/Parte3_2020_Journal_of_Private_Enterprise_Vol_35_No_3_Fall; D. J. Deming (2011), Better schools, less crime? Quarterly Journal of Economics, 126(4), pp. 2063-2115, https://doi.org/10.1093/qje/qjr036; A. K. Dills and R. Hernández-Julián (2011), More choice, less crime, Education Finance and Policy, 6(2), 2011, 246-266, https://doi.org/10.1162/EDFP_a_00033; W. Dobbie R. G. Fryer, Jr. (2015), The medium-term impacts of high-achieving charter schools, Journal of Political Economy, 123(5), pp. 985-1037, https://doi.org/10.1086/682718; and A. McEachin, D. L. Lauen, S.C. Fuller, and R.M. Perera (2020), Social returns to private choice? Effects of charter schools on behavioral outcomes, arrests, and civic participation, Economics of Education Review, 76 (June), https://doi.org/10.1016/j.econedurev.2020.101983.

[8] Patrick J. Wolf (2007), Civics Exam, Education Next, 7(3), https://www.educationnext.org/civics-exam/; Corey A. DeAngelis (2017), Do Self-Interested Schooling Selections Improve Society? A Review of the Evidence. Journal of School Choice, 11(4), pp. 546–558, https://dx.doi.org/10.1080/15582159.2017.1395615;

[9] M. Danish Shakeel and Patrick J. Wolf, “The Evidence Is In: Private Schools Make Good Citizens,” RealClear Education, May 10, 2024, https://www.realcleareducation.com/articles/2024/05/10/the_evidence_is_in_private_schools_make_good_citizens_1030904.html

[10] EdChoice (2023), The 123s of School Choice: What the Research Says about Private School Choice Programs in America, 2023 edition, retrieved from: https://www.edchoice.org/wp-content/uploads/2023/07/123s-of-School-Choice-WEB-07-10-23.pdf

[11] Yujie Sude, Corey A. DeAngelis, and Patrick J. Wolf, Ph.D., “Supplying Choice: An Analysis of School Participation Decisions in Voucher Programs in DC, Indiana, and Louisiana,” Louisiana Scholarship Program Evaluation Report #9, June 2017, https://educationresearchalliancenola.org/files/publications/Sude-DeAngelis-WolfSupplying-Choice.pdf

[12] Benjamin Scafidi and Jonathan Butcher (2023). The Fiscal Effects of Expanding Mississippi’s Education Savings Accounts, EdChoice, Working Paper No. 15, p. 19, https://www.edchoice.org/wp-content/uploads/2023/12/ESA-Fiscal-Impact-12_19_23.pdf

[13] Danish Shakeel, Kaitlin P. Anderson, and Patrick J. Wolf (2021), The participant effects of private school vouchers around the globe: a meta-analytic and systematic review, School Effectiveness and School Improvement, 32(4), pp. 509-542, https://doi.org/10.1080/09243453.2021.1906283.

[14] Ibid.

[15] R. Joseph Waddington and Mark Berends (2018), Impact of the Indiana Choice Scholarship Program: Achievement Effects for Students in Upper Elementary and Middle School, Journal of Policy Analysis and Management, 37(4), pp. 783–808, https://dx.doi.org/10.1002/pam.22086; David Figlio and Krzysztof Karbownik (2016), Evaluation of Ohio’s EdChoice Scholarship Program: Selection, Competition, and Performance Effects, retrieved from Thomas B. Fordham Institute website: https://fordhaminstitute.org/sites/default/files/publication/pdfs/FORDHAM-Ed-Choice-Evaluation-Report_online-edition.pdf

[16] Patrick J. Wolf (2012), The Comprehensive Longitudinal Evaluation of the Milwaukee Parental Choice Program: Summary of Final Reports (SCDP Milwaukee Evaluation Report 36), retrieved from University of Arkansas Department of Education Reform website: https://bpb-us-e1.wpmucdn.com/wordpressua.uark.edu/dist/9/544/files/2018/10/report-36-the-comprehensive-longitudinal-evaluation-of-the-milwaukee-parental-choice-program-1cz13q3.pdf

[17] EdChoice (2023), The 123s of School Choice: What the Research Says about Private School Choice Programs in America, 2023 edition, retrieved from: https://www.edchoice.org/wp-content/uploads/2023/07/123s-of-School-Choice-WEB-07-10-23.pdf

[18] Dennis Epple, Richard E. Romano, and Miguel Urquiola (2017), School Vouchers: A Survey of the Economics Literature, Journal of Economic Literature, 55(2), p. 441, https://dx.doi.org/10.1257/jel.20150679; Patrick J. Wolf and Anna J. Egalite (2016), Pursuing Innovation: How Can Educational Choice Transform K–12 Education in the U.S.?, p. 1, retrieved from EdChoice website: https://www.edchoice.org/wp-content/uploads/2016/05/2016-4-Pursuing-Innovation-WEB-1.pdf; Anna J. Egalite and Patrick J. Wolf (2016), A Review of the Empirical Research on Private School Choice, Peabody Journal of Education, 91(4), p. 451, https://dx.doi.org/10.1080/0161956X.2016.1207436; Anna J. Egalite (2013), Measuring Competitive Effects from School Voucher Programs: A Systematic Review, Journal of School Choice, 7(4), p. 443, https://dx.doi.org/10.1080/15582159.2013.837759

[19] Huriya Jabbar, Carlton J. Fong, Emily Germain, Dongmei Li, Joanna Sanchez, WeiLing Sun, and Michelle Devall (2019), The competitive effects of school choice on student achievement: A systematic review, Educational Policy, 36(2), pp. 1-35, https://doi.org/10.1177/0895904819874756

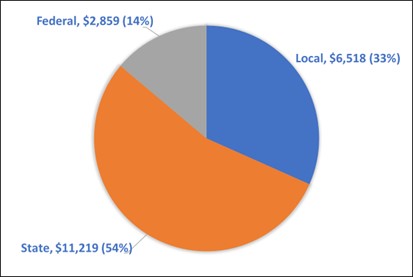

Public school districts receive funding from local, state, and federal sources. In school year 2021-22, California public schools received $121.4 billion in total revenue, or $20,596 for each K–12 student.[1] Figure 1 displays the share of revenue by source for California public schools. State revenue (54% of total revenue) represents the largest source of funding for public schools and comes from state taxes, such as income and sales tax. Local revenue (33% of total revenue) mostly comes from local property taxes. The remaining 14% comes from the federal government.

Figure 1: Revenue for California Public School Systems by Source, School Year 2020–21

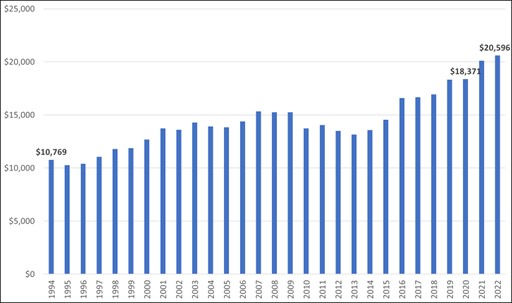

Investment in California’s public school systems by taxpayers has grown for decades. Based on data reported by the California Department of Education to the U.S. Department of Education, inflation-adjusted revenue for public school systems increased from almost $10,800 in FY 1994 (in 2022 dollars) to about $20,100 per student in FY 2022 (Figure 2). In other words, California public school students today have 91% more real resources (resources above inflation) than California public school students in FY 1994. Thus, resources devoted to funding California’s public school systems have increased, in real (inflation adjusted) terms, by an average of 3.1% year over year.

After 2010, funding declined due to the Great Recession. This period of decreased funding was temporary, however, and funding resumed increasing in 2013, shortly surpassing pre-recession levels after three years.

Funding increased by $2,224 per student from FY 2020 to FY 2022. The reason for this increase is that in FY 2021, public schools received significant amounts of funding from the federal government in the form of Elementary and Secondary School Emergency Relief (ESSER) funds. These funds were allocated to help schools address the impact of the Covid pandemic on education. Even prior to this infusion of resources, however, investment in California public schools, in real terms, increased year over year by 70% through FY 2020, or by an average of 2.6% per year.

Figure 2: Revenue Per Pupil for California Public School Systems, FY 1994 to FY 2022

($ adjusted for inflation)

California’s Local Control Funding Formula (LCFF)

How funding for K–12 public schools changes when enrollment changes is complex because it involves various revenue sources and funding mechanisms. In 2013, California enacted a new school funding formula known as the Local Control Funding Formula (LCFF). The LCFF allocates funds based on three main components:[2]

These amounts may be adjusted from year to year for factors such as cost of living adjustments.

California also has a funding protection policy in place for school districts that experience enrollment declines. Under this protection, LCFF allocations for districts are determined by the higher of the district’s current year ADA or the average ADA of the prior three years.[3] This protection simultaneously represents a cost for state taxpayers and a fiscal benefit for school districts and local taxpayers. For simplicity, the present analysis does not incorporate this funding mechanism. If triggered for a district, this funding mechanism would generate additional fiscal benefits for the district while generating an additional cost for the state.

Evaluating the potential fiscal impact of a choice program on state taxpayers and school districts requires an estimate for the state’s marginal cost to educate students in public schools. To isolate the potential impacts on public school districts only, the present analysis excludes charter schools. It uses a weighted average of the LCFF base grant per funded Average Daily Attendance (ADA). To derive these estimates for each district and statewide, I merged data files obtained from the California DOE. The estimates use data on the LCFF Derived Value of ADA by Grade Span for School Districts which provide entitlement amounts by grade level.[4] The analysis estimates the average LCFF entitlement weighted by funded ADA counts by grade level for 2022-23.[5]

The statewide average LCFF entitlement is $12,523 per funded ADA. Thus, when a student leaves a district school for any reason, then the district’s state revenue will decrease by $12,523, on average.

[1] Cornman, S.Q., Doyle, S., Moore, C., Phillips, J., and Nelson, M.R. (2024). Revenues and Expenditures for Public Elementary and Secondary Education: School Year 2021–22 (Fiscal Year 2022): First Look (NCES 2024-301). U.S. Department of Education. Washington, DC: National Center for Education Statistics. Retrieved 6/28/2024 from http://nces.ed.gov/pubsearch.

[2] California Department of Education, “LCFF Frequently Asked Questions,” [website], retrieved 12/31/2023 from https://www.cde.ca.gov/fg/aa/lc/lcfffaq.asp

[3] California Department of Education, “Local Control Funding Formula Overview” [website], accessed 6/30/2024 at https://www.cde.ca.gov/fg/aa/lc/lcffoverview.asp

[4] California Department of Education, LCFF Derived Value of ADA by Grade Span for School District and Charter Schools: Based on 2022–23 Second Principal (P-2) Apportionment [spreadsheet], www.cde.ca.gov/fg/au/ag/documents/adavalue22.xlsx

[5] California Department of Education, LCFF Summary Data: 2022–23 Second Principal Apportionment [spreadsheet], https://www.cde.ca.gov/fg/aa/pa/documents/lcffsummary2223.xlsx

This section specifies how the analysis measures costs and savings. Taxpayers incur a cost for education savings account (ESA) programs in the form of payments for ESAs. There are also savings from ESA programs because public schools no longer spend money on students who do not enroll in a public school via the ESA. The paper refers to students who otherwise would have enrolled in a public school without ESA funding as switchers. The net fiscal effect (NFE) of an ESA program is:

NFE = [Cost Reduction from Switchers] – [Cost of ESA Program][1]

These fiscal effects usually differ for state and local taxpayers. As such, in addition to estimating an overall NFE for a program, this report also isolates the fiscal effects on state taxpayers and local taxpayers.

State Fiscal Effect

The net fiscal effect for state taxpayers (State_NFE) is:

State_NFE = [State savings from switchers] – [Total state cost of ESA program]

The state pays for the full cost of an educational choice program. It also experiences a fiscal benefit by supporting fewer students in the public-school system when students leave public schools via the choice program. The equation above accounts for the total cost of the choice program for all student participants and state savings from students switching from the public school system into the choice program. The switcher rate represents an important factor for a fiscal analysis and is discussed later in this section.

Local Short-Run Fiscal Effects

Some stakeholders may be concerned with the local fiscal effect because choice critics often claim that choice harms public schools by decreasing revenue after students leave. To address these concerns, the present analysis estimates the net short-run fiscal effect on public schools (Local_SR_NFE):

Local_SR_NFE = [Short-run variable cost savings from switchers] – [Reduction in revenue from switchers]

Variable educational costs represent costs that change with enrollment. The section below discusses educational costs in more detail.

Fiscal benefits for local taxpayers may or may not materialize as direct reductions in their tax bills. Although this is a policy choice for local governments, local governments usually do not reduce taxpayer burden.[2] When localities do not reduce property taxes with decreasing educational costs, the level of resources that districts have for fewer students on a per-pupil basis will increase, a common byproduct of choice programs.

To estimate short-run average variable costs, the present analysis uses categorical school expenditure data from the National Center for Education Statistics at the U.S. Department of Education. The analysis considers the following three categorical expenditures variables in the short run: Instruction, Instructional Support Services, and Student Support Services.[3] The analysis considers all other expenditures as fixed costs, including capital outlay, maintenance, debt service, transportation, food service, transportation, school and district administration, and numerous other categories. This method represents a cautious approach because some of these categories, such as transportation and food service, are variable or semi-variable in the short run. This approach is also more cautious than methods used by some economists.[4]

To derive estimates for short-run variable costs, I first estimate the percentage of total costs that are variable in the short run. I then apply these rates to the most recent available cost data reported on the California Department of Education’s website. On a statewide per-pupil basis, the estimated short-run variable cost for California public schools is about $12,000 per student, or 59% of total cost.

Local Long-Run Fiscal Effects

The analysis estimates the net long-run fiscal effect on local taxpayers and public schools (Local_LR_NFE) as:

Local_LR_NFE = [Long-run variable cost savings from switchers] – [Reduction in revenue from switchers]

where the average long-run variable cost savings equals the average total expenditures associated with the students switching from public schools.

A fundamental economic principle is that all costs are variable in the long run. This means that any economic entity, such as public school districts, will adapt to changing conditions such as enrollment changes as needed. For instance, if a district’s enrollment decreases by 5%, then over time the district will reorganize to reduce costs by 5%. California’s funding protection policy provides additional support that allows more time for districts to adapt.

All state agencies report total expenditures to the U.S. Department of Education annually. While these data are readily available, they are lagged by a couple years. The most recent data at the state level from the U.S. Department of Education at the time the present analysis was conducted was FY 2022.[5] The statewide average total expenditures per student for FY 2022 is $20,596 per student. This value is used for estimated long-run variable costs for public schools.

Combined Fiscal Effect

Because taxpayers pay both state and local taxes, some stakeholders will be interested in the combined state and local net fiscal effects. The net combined short-run fiscal effect on state and local taxpayers (Combined_SR_NFE) is:

Combined_SR_NFE = [Short-run variable cost savings from switchers] – [Total cost of ESA program]

The combined net fiscal effect is the difference between the short-run variable cost savings from switchers and the total cost of providing ESAs for students.

The net combined long-run fiscal effect on state and local taxpayers (Combined_LR_NFE) is:

Combined_LR_NFE = [Long-run variable cost savings from switchers] – [Total cost of ESA program]

The combined net fiscal effect is the difference between long-run variable cost savings from switchers and the total cost of providing ESAs for students.

Educational Costs

Opponents of educational choice often raise concerns about policies supporting educational opportunities outside the public system because they suggest that public schools primarily have fixed costs. They imply that if this were true, funding schools based on enrollment would not be necessary—instead, the state could solely cover the fixed costs of districts. Some of these same critics, however, advocate for increased public school funding, arguing that more resources are required with rising enrollment, suggesting that schools have significant variable costs. These conflicting viewpoints cannot both hold true at the same time. In the short term, some educational expenses remain fixed while others vary, and in the long term all costs become variable. This analysis acknowledges and aims to account for this short-term reality.[6]

Switcher Rates

Switchers are students who would have enrolled in public school systems without financial assistance from the choice program.[7] They represent both a cost and savings and are an important factor in fiscal impact calculations for choice programs. Non-switchers are students who would have enrolled in a nonpublic school setting if not for financial assistance from the choice program. Non-switchers represent a pure cost for choice programs because they do not generate any savings.

The switcher rates can be influenced by numerous factors, including the funding allocated to families and the eligibility criteria of programs, which notably differ among current programs. Certain programs have eligibility limitations tied to income and specific needs, while others mandate prior enrollment in a public school before joining. Yet, some programs that demand prior public school enrollment offer exceptions such as kindergarten students, students from military families, and students in foster care. The funding level and available choices can significantly influence families’ choices to engage in these programs.

States are increasingly opening choice programs to students already enrolled outside the public school system. Programs in Arizona, Florida, and Oklahoma, among others, are open to all K–12 students regardless of where they are enrolled prior to participating in the choice program. New Hampshire’s ESA program is open to families with annual household income up to 300% of the federal poverty level ($79,500 for a family of four in 2021) and does not have a prior public school enrollment requirement.[8] Indiana expanded its voucher program to students from families that earn up to 400% of the amount required to qualify for the free and reduced-price lunch program ($220,000 for a family of four in 2023-24) and no longer has a prior public school enrollment requirement.

To participate in West Virginia’s ESA program, students must have attended public K–12 schools for at least 45 full-time instruction days or been enrolled in public school for the entire previous school year. All kindergarten students, however, are eligible for West Virginia’s program.[9]

Some other programs with prior public enrollment requirements also have exceptions to those requirements, like West Virginia. The Racine (Wisconsin) Parental Choice Program grants exemptions to students in kindergarten, first grade, and ninth grade who were not enrolled in a public school the previous year. Other programs waive the requirement for prior public enrollment for students coming from failing public school districts.[10]

These complexities can make it difficult to estimate the switcher rate for a hypothetical new program, but there is a body of research that sheds some light on the question. One paper synthesized random assignment studies conducted in programs that were mostly restricted to low-income families, some of which had prior enrollment requirements, and some of which did not. Researchers of these random assignment studies observed the type of school that students enrolled in after they were not awarded a voucher via a randomized lottery. Thus, the body of random assignment research provides plausible estimates for the rate of switching among students eligible for choice programs. Overall, these studies estimated average switcher rates around 90%.[11]

Using switcher rates around 90% would be appropriate for applying to targeted programs or programs with strict public school prior enrollment requirements, such as the near-universal program considered in the present analysis. It would not be appropriate, however, for programs that are broadly open to students outside the public school system.

Program data on participation of new students in Arizona’s universal ESA program indicate a much lower switcher rate, about 20% during the program’s first expansion year, though this rate increased to 62% in the program’s second year.[12] Arizona, however, has had private choice programs since 1997, including four tax-credit scholarship programs, and may not be representative of most states because it provides families with a uniquely choice-rich environment for K–12 education. Many students were already participating in the state’s choice programs before they switched over to the ESA program. Therefore, while the switcher rate among new students for this program is quite low compared to more targeted programs, the overall program switcher rate is higher when other students are included in the counts.

The present analysis considers a near-universal program in California that is modeled after the ESA program created in West Virginia. In this program, all public school students and all students in kindergarten and first grade are eligible. The analysis applies a switcher rate of 90% to generate fiscal effects estimates, based on the body of random assignment studies referenced above.

Break-Even Switcher Rate (BESR)

The break-even switcher rate (BESR) is the rate that balances the program’s costs and savings to achieve fiscally neutral:

BESR = [ESA program cost per student] / [per-student savings from switchers]

For the program to be fiscally neutral for the state, the BESR is the rate that equals the average marginal per-student cost of the ESA divided by the average state savings for each switcher.

Let’s consider an example where a program awards ESAs worth $6,000 for each student who participates in the program. If the average marginal cost per student to the state for educating a child in the public-school system is $10,000, then the BESR is 60% (= $6,000 / $10,000). The program will generate net fiscal savings for state taxpayers if more than 60% of ESA students are switchers.

The fiscal effect of choice programs is a matter of design. It is possible to design a program with cost savings in mind. Consider that the state’s average marginal cost to fund K–12 students in California’s public-school system is about $12,500. This is the average LCFF funding per student. A choice program that provides ESAs worth 90% of this cost, or $11,250, implies a BESR of 90%. Therefore, if more than 90% of students participating in the program are switchers, then the program will generate net savings for state taxpayers. This is a plausible outcome for a program designed after West Virginia’s near-universal program and supported by the body of random assignment studies of voucher programs that, overall, find 90% of students ended up enrolling in public school systems after they applied to oversubscribed choice programs and lost a lottery.

Take-up Rates

The last key assumption for the analysis involves the take-up rate (TUR). The TUR is the percentage of eligible students who participate in the ESA program:[13]

TUR = [number of choice program participants] / [number of eligible students]

The analysis uses 1% and 10% take-up rates. EdChoice conducted an analysis of participation in choice programs and looked at take-up by year in operation and by program type.[14] Overall, the average take-up rate for all choice programs was 0.41% in programs’ first years, 1.22% by their third years, and 1.80% by their fifth years. By their tenth year, the take-up rate for all programs was 2.62%. These participation rates largely reflect targeted programs, had prior public school enrollment requirements, or had other significant limitations on participation.

Take-up rates for ESA programs were 0.25% in the first year, 1.07% by the third year, and 6.58% by the tenth year. Notably, these ESA programs at the time of the sample period were targeted to students with special needs. The take-up rate decreased after states expanded their programs to all K–12 students.

Arizona currently has the highest take-up rate among universal choice programs, 5.9%. As noted before, Arizona is different from most choice states because it has had a robust school choice ecosystem for long enough that ESAs are just one option among many. Although the current analysis uses a 10% take-up rate to generate upper-bound estimates, fiscal estimates based on this assumption should be viewed as representing a program in the very long run. The likely scenario for the near-term will be based on the low-end take-up rate.

[1] For a more formal and complete treatment of the fiscal effects discussed in this section, please see: Lueken (2021), The Fiscal Effects of School Choice, Ibid.

[2] James R. Hines and Richard H. Thaler (1995), The Flypaper Effect, Journal of Economic Perspectives, 9(4), pp. 217-226, https://pubs.aeaweb.org/doi/pdfplus/10.1257/jep.9.4.217

[3] This approach follows Lueken (2021), The Fiscal Effects of School Choice, Ibid.

[4] Benjamin Scafidi (2012) estimated short-run variable costs for public schools in each state. They were based on experiences of public school districts in Georgia that experienced enrollment declines. His analysis found that these districts were able to reduce expenditures for five categories from one year to the next that were more than commensurate with their enrollment decrease. These categories were the three categories used in the present analysis, plus enterprise operations and food service. Estimates in the present analysis are below variable cost estimates used by Scafidi, as well as Bifulco and Reback’s variable cost estimates for Albany and Buffalo.

Benjamin Scafidi, The Fiscal Effects of School Choice Programs on Public School Districts, Friedman Foundation for Educational Choice, retrieved from EdChoice website: https://www.edchoice.org/research/the-fiscal-effects-of-school-choice-programson-publicschool-districts; Robert Bifulco and Randall Reback (2014), Fiscal Impacts of Charter Schools: Lessons from New York, Education Finance and Policy 9(1), pp. 86–107, http://dx.doi.org/10.1162/EDFP_a_00121

[5] Cornman, S.Q., Doyle, S., Moore, C., Phillips, J., and Nelson, M.R. (2024). Revenues and Expenditures for Public Elementary and Secondary Education: School Year 2021–22 (Fiscal Year 2022): First Look (NCES 2024-301). U.S. Department of Education. Washington, DC: National Center for Education Statistics. Retrieved from http://nces.ed.gov/pubsearch

[6] For further discussion on this topic, please see: Martin F. Lueken (2017), On Educational Costs: Fixed, Quasi-fixed and Variable Costs, EdChoice, https://www.edchoice.org/wp-content/uploads/2017/06/2017-3-Fixed-vs-Variable-Cost-One-Pager.pdf

[7] The status of program participants as switchers is not directly observable. Switchers may include program participants enrolling in a school for the first time (e.g., kindergarten students) who do not actually “switch” from a public school. Even if a student attended a nonpublic school before receiving a scholarship, it could be the case that she would have entered a public school sometime in the future (perhaps in the beginning of high school) without the financial assistance from the program. This student would generate savings from the point of entering public school. On the other hand, it is possible to observe a student in public school before receiving a scholarship who would have entered a private school sometime in the future even without financial assistance from a scholarship. Such a student in a choice program would generate costs from the point she leaves public school.

[8] “School Choice in America Dashboard,” EdChoice, last modified March 1, 2021 http://www.edchoice.org/school-choice/school-choice-in-america.

[9] Ibid.

[10] Appendix 1 in Lueken (2021), The Fiscal Effects of School Choice summarizes prior public school enrollment requirements for programs included in that study.

[11] Martin F. Lueken (2020), The Fiscal Impact of K–12 Educational Choice: Using Random Assignment Studies of Private School Choice Programs to Infer Student Switcher Rates, Journal of School Choice, 15(2), pp. 170–193.

[12] Arizona Department of Education (2024), Empowerment Scholarship Program: Fiscal Year 2024 Quarter 3 Report, Pursuant to A.R.S. § 15-2406, May, https://www.azed.gov/sites/default/files/2024/05/ESA%20FY24%20Q3%20Executive%20%26%20Legislative%20Report%20%283%29%20secured%205.31.24.pdf.

[13] The take-up rate helps determine the total size of the fiscal effects. Ceteris paribus, a higher take-up rate implies both greater savings and costs.

[14] EdChoice (2023), Participation in Private Education Choice Programs, Fiscal Research and Education Center, https://www.edchoice.org/wp-content/uploads/2023/02/Participation-in-Private-Education-Choice-Programs.pdf

ESA Models Under Consideration

This report presents three models. It considers three ESA amounts for a near-universal choice program designed after West Virginia’s ESA program. Under the near-universal ESA program, all K–12 public school students plus all students in kindergarten and first grade are eligible.

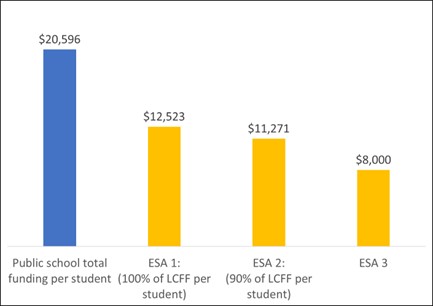

The analysis considers three ESA values. It sets an ESA at 100% of the statewide average LCFF per student ($12,523), an ESA at 90% of the statewide average LCFF per student ($11,271), and an ESA at $8,000.[1] Under these ESA amounts, the per-student program cost is 39% to 61% of the total per-student cost to educate the same student in the public-school system (Figure 3).

To summarize, the analysis considers the following three models:

Figure 3: Average cost per student for California public school systems and ESA amounts considered in the fiscal analysis

The analysis generates estimates under two take-up rates: 1% and 10%. No statewide choice program has achieved a 10% participation rate, even after decades of experience with these programs, though a few states are steadily approaching this milestone. Arizona expanded its ESA program to include every K–12 student in the state. It currently has 70,925 students participating in this program, which represents about 6% of eligible students.[2] Arizona’s ESA program has been around since 2011, and its other choice programs have been around for more than 25 years. Thus, if any choice program in California achieves a 10% take-up rate, it will likely take many years. The typical experience of states that introduce choice programs is that these programs start small and grow slowly over time.[3]

Because the models under consideration are open to students currently outside the public school system, the analysis assumes the switcher rate for the program overall is 90%.

Overall Fiscal Effects

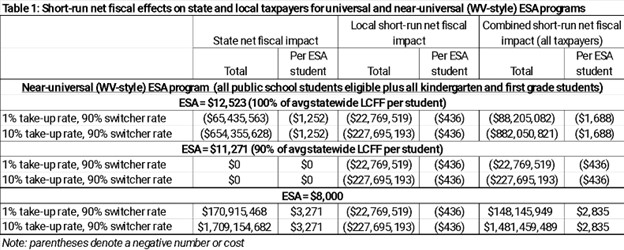

Table 1 presents a summary of results for short-run fiscal effects on the state budget, public school districts, and all taxpayers (combined state and local impact). Table 2 summarizes the long-run fiscal effects results later in this section.

The top panel in Table 1 considers a near-universal ESA program where the ESA is equal to 100% of the average statewide LCFF cost per student while the middle panel considers an ESA equal to 90% of the average statewide LCFF cost per student. The bottom panel provides estimates for an ESA value of $8,000. Results are reported for 1% and 10% take-up rates. Based on the experiences of choice programs in other states, the 1% take-up rate is a more likely scenario in the near-term than the higher rate (10%).

The analysis assumes a 90% switcher rate. If the ESA amount is set at 90% of the state’s average marginal per-student cost to fund students’ education in the public school system (the average LCFF cost per student), the break-even switcher rate for the state is 90%. This means that if 90% of ESA students are switchers, then the program will be cost-neutral for the state. If more than 90% of ESA students are switchers, then the state will experience net savings. If less than 90% of ESA students are switchers, then the state will incur net costs.

The first row in the top panel shows results for a near-universal ESA program where the ESA amount is $12,523 (100% of the average statewide LCFF entitlement per student), the take-up rate is 1%, and the assumed switcher rate is 90%. Let’s walk through the calculations for this scenario.

Scenario 1: near-universal ESA program, ESA amount = $12,523, take-up rate is 1%, switcher rate is 90%

Student enrollment in California public schools is 5,145,585. California private school enrollment is 516,571. Assuming private school enrollment is uniformly distributed across grades, 2/13 (15.4%) of K–12 private school students, or 79,472, are in kindergarten and first grade. These students are exempt from the ESA program’s public school prior enrollment requirement.

The total number of eligible students for the program is 5,225,057. A 1% take-up rate implies 52,251 total ESAs distributed to students. A 90% switcher rate means that 47,026 students in the near-universal ESA program are switchers and generate fiscal benefits for state and local taxpayers.

State net fiscal effect

The total cost of the ESA program for the state is:

(52,251 ESA students) x ($12,523 per ESA) = $654,355,628

Total savings for the state is:

(47,026 switchers) x ($12,523 average LCFF payment per student) = $588,920,065

The net fiscal impact for the state is:

($588,920,065 savings from switchers) – ($654,355,628 cost for ESAs) = –$65,435,563 net cost

The state net fiscal impact is a cost of $65.4 million, or $1,252 per ESA.

Local short-run net fiscal effect

Reduced LCFF payments from switchers who leave via the ESA program for school districts is:

(47,026 switchers) x ($12,523 average LCFF entitlement per student) = $588,920,065

Total short-run variable savings from switchers is:

(47,026 switchers) x ($12,039 est. average short-run variable costs per student) = $566,150,546

The net fiscal impact for local taxpayers is:

($566,150,546 short-run variable savings) – ($588,920,065 reduced LCFF payments) = –$22,769,519 net costs

The local short-run net fiscal impact is a cost, $22.8 million, or $436 per ESA.

Combined short-run net fiscal effect

The combined short-run net fiscal impact on state and local taxpayers is:

(–$65,435,563 state cost) + (–$11,445,561 local savings) = –$88,205,082 cost

The combined short-run net fiscal impact is a cost of $88.2 million, or $1,688 per ESA.

A fundamental economic principle is that in the long run, all costs are variable. Thus, variable savings for districts will be higher in the long run. Table 2 summarizes estimates for the long-run net fiscal effects.

Below we walk through the local and combined state and local long-run net fiscal effects by continuing with the same scenario discussed above.

Scenario 1 (continued): near-universal ESA program, ESA amount = $12,523, take-up rate is 1%, switcher rate is 90%

Local long-run net fiscal effect

Reduced LCFF payments from switchers who leave via the ESA program for school districts is:

(47,026 switchers) x ($12,523 LCFF entitlement per student) = $588,920,065

Total short-run variable savings from switchers is:

(47,026 switchers) x ($20,596 total public school cost per student) = $968,559,503

The net fiscal impact for local taxpayers is:

($968,559,503 long-run variable savings) – ($588,920,065 reduced LCFF payments) = $379,639,438 net savings

The local long-run net fiscal impact is positive, $379.6 million in savings, or $7,266 per ESA.

Combined long-run net fiscal effect

The combined long-run net fiscal impact on state and local taxpayers is:

(–$65,435,563 state cost) + ($379,639,438 local savings) = $314,203,875 combined savings

The combined long-run net fiscal impact is positive, $314.2 million in net savings, or $6,013 per ESA.

The second scenario considers an ESA amount equal to 90% of the statewide average LCFF entitlement ($11,271) per student under a near-universal ESA program.

Scenario 2: near-universal ESA program, ESA amount = $11,271, take-up rate is 1%, switcher rate is 90%

Short-run net fiscal effects

The state net fiscal effect is zero.

The local short-run net fiscal effect is a cost of $22.8 million, or $436 per ESA.

The combined short-run net fiscal effect is a cost of $22.8 million, or $436 per ESA.

Long-run net fiscal effects

The state net fiscal effect is zero.

The local long-run net fiscal effect is $379.6 million in savings, or $7,266 per ESA.

The combined long-run net fiscal effect is $379.6 million in savings, or $7,266 per ESA.

The final scenario considers an ESA amount equal to $8,000 per student under a near-universal ESA program.

Scenario 3: near-universal ESA program, ESA amount = $8,000, take-up rate is 1%, switcher rate is 90%

Short-run net fiscal effects

The state net fiscal effect is $170.9 million in savings.

The local short-run net fiscal effect is a cost of $22.8 million, or $436 per ESA.

The combined short-run net fiscal effect is $148.1 million in savings, or $2,835 per ESA.

Long-run net fiscal effects

The state net fiscal effect is $170.9 million in savings.

The local long-run net fiscal effect is $379.6 million in savings, or $7,266 per ESA.

The combined long-run net fiscal effect is $550.6 million in savings, or $10,537 per ESA.

The next section examines the potential fiscal impact on the ten largest public school districts in California. These local effects are independent of program eligibility among non-public school students. That is, non-switchers do not have a fiscal effect on local districts and will affect only the fiscal impact on state taxpayers. The local effect is isolated to take-up among eligible public school students who choose to participate in the ESA program.

Fiscal Effects for Ten Largest Public School Districts