Union dues are cutting into teacher’s retirement funds

Union dues take a large bite out of the paychecks of California teachers. We estimate that newly hired, full-time teachers will pay $37,000 in dues over a 30-year career. Further, if new teachers could fully opt out of the union and instead save their dues in an Individual Retirement Account, they would each have $228,000 extra in after-tax retirement savings.

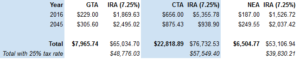

We base these findings on union dues information posted by the Glendale Teachers Association (GTA), which we believe are typical for the rest of the state. The GTA is affiliated with the California Teacher’s Association (CTA), which, in turn, is affiliated with the National Education Association (NEA) – so a new teacher in the Glendale system is effectively joining three unions at once. For the most recent school year, 2016-2017, full-time teachers subject to Category 1 union dues, paid $229 to the Glendale Teacher’s Association, $656 to the California Teacher’s Association, and $187 to the National Education Association – an annual total of $1,072 in union dues.

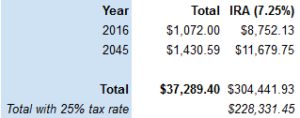

Now let’s consider a hypothetical teacher that began his or her career in August 2016. If we assume that union dues grow at a rate of 1% annually, this teacher would end up spending just over $37,000 in union dues by 2045. Union dues increased by 1.8% from the 2015-2016 to the 2016-2017 school years. Therefore, using a 1% growth rate in our calculations is a conservative estimate to account for any periods when union dues do not increase.

Now let’s consider an alternative use for this $37,000. How much could that teacher have earned if he or she had been able to invest that money in a retirement account? An account earning 7.25% annually (the rate of return currently assumed by CalSTRS) would have provided this teacher with $304,000 by 2045. Even if we assume this teacher would be subject to a 25% tax rate on this investment, the fund would still provide $228,000 for retirement.

Contributions to Union Dues by Union Over 30 Years

Total Contributions to Union Dues Over 30 Years

As noted, we made these calculations based on union dues in Glendale; they may be somewhat more or less elsewhere. Additionally, part-time teachers pay lower dues, but the difference is roughly proportional to the difference in salary between a part-time and full-time teacher.

Unlike most states, California is not a “Right to Work” state. This means that in the state of California, if an individual works in a unionized workplace – such as a public school – that individual must join the union. There are two exceptions: religious/conscientious objectors (who must instead of paying dues pay the equivalent amount to a charity of the union’s choosing) and agency fee users (who receive a rebate of a portion of their union dues that would have gone toward political activities).

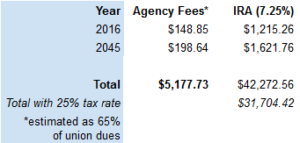

In theory, it is great that teachers who do not agree with the activities of the union due to religious reasons can opt out. However, these teachers are still unable to benefit from investing their money in a retirement fund. Even teachers who pay only the agency user fee could end up paying approximately 65% of the full union dues.

That said, let’s take a look at how much money the 10% of teachers who opt out of union membership still pay in agency user fees. Additionally, we will look at how much that money could earn if the teachers had been able to invest it in a retirement fund.

A teacher in Glendale, California who opts out of joining the union, but still owes agency fees, will end up paying roughly $24,000 during a 30-year career. That same amount of money could be invested in a retirement account growing at an annual rate of 7.25%. In 2045, that teacher would have just north of $197,000 saved for retirement, or $148,000 after accounting for an estimated 25% tax rate.

Total Estimated Contributions to Agency Fees Over 30 Years

Ironically, a portion of each teacher’s union dues funds compensation of union executives who make far more than even the highest-paid teachers. For example, CTA’s executive director received $426,059 in 2015. That same year, the president of CTA received $287,440. If teachers were not footing the bill for these extravagant salaries, they would have more money for their retirement.

We understand that union dues are tax deductible, and that would be a good way to lessen the burden of union dues. But that deduction is only available to teachers who itemize. Also, union dues are subject to the “2% Limit” which states that taxpayers can only “claim the amount of expenses that is more than 2% of your adjusted gross income.” Keeping this in mind, the way unions determine the amount of dues is through a formula so that dues are approximately 2% of a new teacher’s salary. Therefore, it is unlikely that a teacher will be able to deduct union dues from his or her taxes.

California teachers pay an exorbitant amount of money in union dues, with much of the money going to political activities and high executive compensation that don’t clearly benefit classroom-based educators. If you’re a California teacher and want to know how much extra you could be saving for retirement, send us the details regarding your union dues from the most recent school year, and we’ll perform the calculations for you!

Jackie Lavalleye has joined the team at California Policy Center this summer as a Financial and Economic Data Research intern. While interning, Jackie is also working toward a Master’s degree in Applied Economics at the University of Maryland.