Will Another Sales Tax Increase Really Help This Southern California City?

The city of Westminster is pursuing the easy road to address its continuing fiscal mismanagement, again. It’s asking its residents to approve yet another sales tax increase, the second in the last two years.

It’s much easier to tell those voting in Westminster that there will be more potholes and less public safety if they don’t approve the small upward adjustment to their nonfood purchases. It eliminates the need of its city council from actually pursuing tough fiscal decisions.

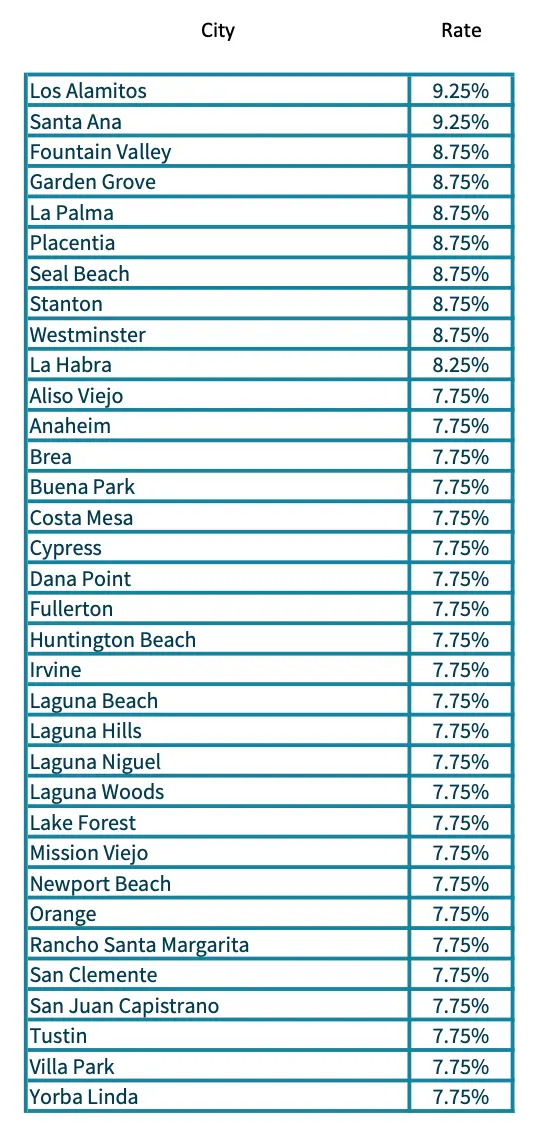

Let’s put this into context. If you’re considering making a purchase of a major appliance or expensive jewelry, you may want to take the location of the retailer into account. It could save you enough to warrant driving a little further. If you purchase a $10,000 item, the sales tax in Santa Ana is $925. But next door in Costa Mesa, it’s $775. That’s a $150 premium. You may want to use the chart below when deciding where to purchase big ticket items.

What really ails this city? The finance director will tell you it was the state of California taking away redevelopment agencies (RDAs) when Jerry Brown was Governor and in need of finding funds to fill his budget deficit back in 2011. RDAs were eliminated because they were abused. Put Westminster’s use of this technique in the mismanagement column. This may seem like a harsh assessment, but I closed the Santa Ana Heights RDA before Mr. Brown’s surprise attack while I served as a county supervisor.

Let’s next look at the city’s balance sheet. Since we have not received the annual comprehensive financial reports for Orange County cities for the year ending June 30, 2023, we’ll look at the prior year.

The stark reality is that Westminster, while in poor fiscal shape, is better than six of Orange County’s cities. Fullerton’s per capita deficit is $1,094, Huntington Beach is at $1,132, Orange at $1,267, Santa Ana at $1,518, Anaheim at $1,623, and last place Costa Mesa at $2,026. Except for Santa Ana, the other five cities are at the 7.75 percent sales tax rate. At least for now.

When Orange County lost some $1.64 billion due to an inappropriate investment scheme, the first remedy that was proposed was a sales tax increase with Measure R in 1995. It’s always the first “go to” solution. But the voters shot it down for one simple reason: They were upset that the county’s elected officials lost the money in the first place, and giving them more funds would only enable them to continue being derelict in their duties.

After Measure R failed, other strategies for those in financial distress were pursued. Other revenue sources were implemented, like increasing waste disposal tipping fee income. Expenses were cut, including many layoffs and departmental downsizing. Assets were reviewed to determine their salability. And borrowings would be refinanced.

When reviewing the City of Westminster’s website, I see no written mention or detailed PowerPoint presentation as to why a sales tax increase should be approved. There wasn’t even a press release on the subject. The budget documents do not provide any cause for alarm or projections of forecasted expenditures exceeding revenues.

The agenda for the Dec. 8 meeting does not permit someone on the website to obtain the slides of the materials and surveys presented. But the actual presentation to the city council emphasized two justifications for putting the sales tax measure on the March ballot.

The first was to make sure that the city would receive the maximum half-cent sales tax increase for its own coffers before another taxing agency, like the County of Orange, implemented a similar strategy. The possibility of being pre-empted is extremely remote and is a weak rationalization.

The second was a timeline projecting that the city’s reserves would be depleted in fiscal year 2027–28, with revenues projected to grow at less than 11 percent and expenditures increasing at 12.5 percent over the next five years.

The presentation did not provide options on where cuts or staff reductions could or could not be made. If addressing unfunded liabilities was discussed, I missed it. It was a presentation solely focused on the easiest solution.

When you ask residents if they would like to continue the city’s level of police protection, it would be difficult to find someone who would disagree. Consequently, surveys indicating support for additional taxes can be biased and emotionally charged. But everyone on a tight budget knows that you can’t have everything you want.

The issue the city council needs to express is their sincerity of resolve, but it was hard to find. And if massive pay raises are granted shortly after the sales tax increase is passed, Westminster residents will find out that they were duped. But it will be too late.

Will Westminster taxpayers be manipulated into another sales tax increase? Or will Anaheim, Santa Ana and Costa Mesa, whose leadership has assured me that their finances are fine, surprise their residents with a similar sales tax increase solution? After all, with gullible voters, it is the easier solution.

John Moorlach is the director of the CPC’s Center for Public Accountability. He has served as a California State Senator and Orange County Supervisor and Treasurer-Tax Collector. This article originally appeared in The Epoch Times.