2024 California Fuel taxes… A DOOSEY

California has collected record gasoline tax revenue in 2024 according to data released by the U.S Census Bureau in December. If Californians buy as much gasoline and diesel as they did the last quarter of 2023, the state will rake in over $10 billion for the year. The final number will not be released for several more months, but it is unlikely Californians will buy less gasoline and diesel given fuel prices have come down since the summer months.

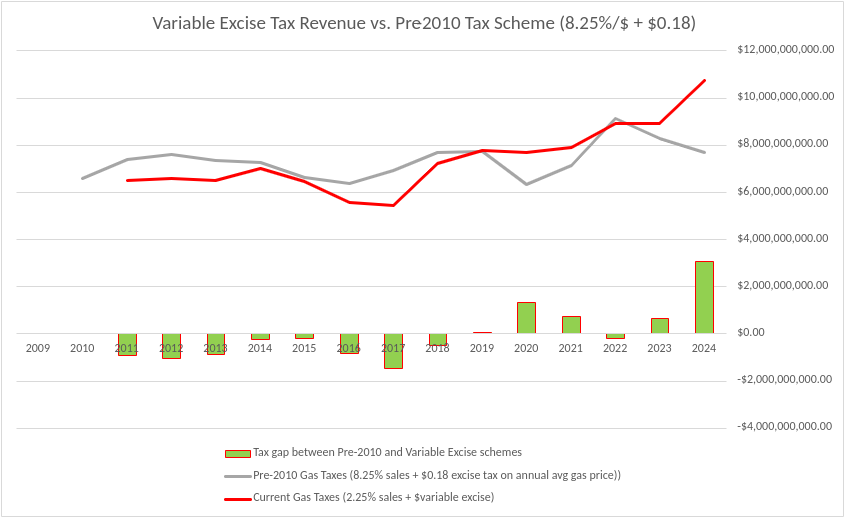

Californians pay the highest fuel taxes in the United States: 60 cents per gallon, plus another 2.25 cents per dollar. The scheme was implemented in 2010 as way to ensure fuel tax revenue would be exclusively spent on roads and bridges. Lawmakers assured voters that the scheme would be equalized to the pre-2010 sales tax method. That promise was kept during the Brown administration, but since 2019 the excise tax revenues have exceeded those of the old sales tax and now has totally diverged from it.

Had the old sale tax been retained, California would have collected less than $8 billion in 2024* (see chart below).

The current per-gallon fuel tax ensure the state government will always have a steady flow of revenue no matter how low the price at the pump. Governor Newsom certainly has an incentive keep fuel prices low by law and administrative harassment and also to keep the public ire directed at companies instead of himself and a cruel tax scheme that only punishes average Californians.

Authored by Truman Angell, oil industry expert.