California Government Pension Contributions Required to Double by 2024 – Best Case

The employer contribution to California’s state and local government pension systems will double, from $31 billion in 2018 to $59 billion by 2024. This estimate is based on aggregating official projections of cost increases issued by CalPERS to their participating agencies, and extrapolating those projections show the overall impact on all of California’s 87 government pension systems.

As reported in the CPC analysis “How Much More Will Cities and Counties Pay CalPERS?,” each of their participating agencies can now view detailed information on the financial status for each of their local pension plans by accessing the “Public Agency Actuarial Valuation Reports” issued by CalPERS actuaries.

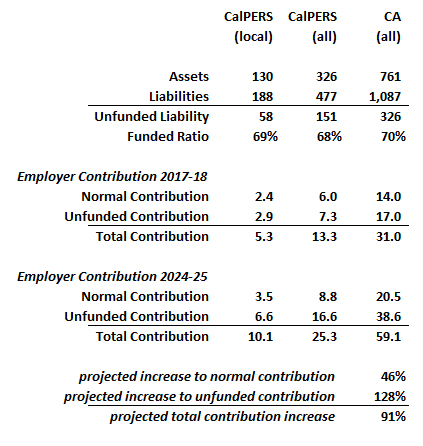

The table below shows, in column one, the sum total of the projections prepared by CalPERS for each of their participating local agencies. As can be seen, local government employers in the CalPERS system are required to contribute $5.3 billion this year. By 2024, that required employer contribution will nearly double, to $10.1 billion.

The middle column in the table extrapolates these projections to the entire CalPERS system, incorporating the state agencies they serve. This is a reasonable extrapolation, since – using data from CalPERS 2016-17 Annual Financial Report – the entire CalPERS system is actually slightly less funded, at 68%, than their local agency plans, at 69%. As can be seen, the entire CalPERS system is estimated to require employer contributions to rise from $13.3 billion this year to $25.3 billion in 2024.

Column three in the table extrapolates this data to incorporate all of California’s state and local government pension systems. Using Census Bureau data, these systems are estimated to have $761 billion in assets. Based on that total, and assuming similar financial profiles for all California’s pension systems – i.e., about 70% funded in aggregate – California’s state and local government employers will pay $31 billion into the 87 various pension systems this year, and by 2024 this payment will rise to $59.1 billion.

Estimated Increase to Employer Pension Contribution

2017-18 compared to 2014-25 ($=B)

When assessing the impact of a nearly $30 billion hike in pension contributions between now and 2024, it’s important to note that these projected payments do not include contributions collected from state and local government employees via payroll withholding. Last year, for example, CalPERS collected $12.3 billion from employers – i.e., taxpayers – and supplemented that with $4.2 billion in employee contributions via payroll withholding (ref. CalPERS CAFR, page 31). Why are the employees only paying 25% of the cost for their benefit? Didn’t the PEPRA reform of 2012 put them on track to pay 50% of the cost of their pensions?

To properly answer this, it is necessary to view the projected changes to the employer “normal contribution,” vs. their “unfunded contribution.” The normal contribution is how much money must go into a pension system in any given year. It represents the amount that has to be invested in the present year to eventually fund the additional retirement benefits earned by employees in that same year. According to PEPRA, this so-called normal contribution is the only portion of an employer’s pension fund payment that employees are required to help pay for. And since the normal contribution has never been enough, pension systems have become underfunded – and the money necessary to catch up, the unfunded contribution, falls 100% on the backs of the taxpayers.

If the unfunded contribution was a trivial amount, because pension fund actuaries had made prudent forecasts, this would be a non-issue. But as summarized last week in the report “Did CalPERS Use Accounting “Gimmicks” to Enable Financially Unsustainable Pensions?,” forecasts were not prudent. They were wildly optimistic. This is why, using official projections, CalPERS requires an unfunded contribution this year that is already 21% greater than the normal contribution, and by 2024, CalPERS will required an unfunded contribution that is 53% greater than the normal contribution.

These are best-case projections, since CalPERS and CalSTRS, along with most of California’s major government pension systems are only lowering their long-term projected rate of return assumptions from 7.5% to 7.0%. All of this, this extra $30 billion per year that California’s taxpayers are going to have to cough up by 2024 to feed the pension systems, is assuming that strong investment returns continue indefinitely. If there is a major correction in the stock market, or in real estate, or in bonds, or in all three, then all bets are off.

After a run-up in the value of invested assets that has now lasted for nearly ten years, CalPERS is only 68% funded, and CalSTRS is only 64% funded. These pension systems are already requiring taxpayers to more than double their payments to reduce an unfunded liability that they’ve already racked up, despite realizing unprecedented gains in an overheated market that is ripe for a correction. When that happens, the payments they’ll require to stay afloat could double again.

If you are wondering what is truly driving the state and local governments’ insatiable desire for more tax revenue, look no further.

* * *